Joining Banking Union Isn't a Panacea

Adelina Marini, July 16, 2014

After consultations with the parliamentary political parties, Bulgaria's President Rosen Plevneliev announced [in Bulgarian] a surprising piece of news, namely that a full consensus had been achieved an immediate procedure to be launched for Bulgaria's accession in the Single Supervisory Mechanism as a first step before full accession in the banking union. Apart from that, a consensus has been reached the Bulgarian National Bank to ask the European Banking Authority to assess the efficiency of the supervision over the Bulgarian banks exercised by the BNB itself. A reason for the surprising piece of news is another episode of the story of Corporate Trade Bank (CTB) - the decision of the central bank to leave CTB to fail and to notify the prosecution of the possibility the main shareholder in the bank, Tsvetan Vasilev, to have stolen almost 103 million euros before the BNB took control over the bank.

After consultations with the parliamentary political parties, Bulgaria's President Rosen Plevneliev announced [in Bulgarian] a surprising piece of news, namely that a full consensus had been achieved an immediate procedure to be launched for Bulgaria's accession in the Single Supervisory Mechanism as a first step before full accession in the banking union. Apart from that, a consensus has been reached the Bulgarian National Bank to ask the European Banking Authority to assess the efficiency of the supervision over the Bulgarian banks exercised by the BNB itself. A reason for the surprising piece of news is another episode of the story of Corporate Trade Bank (CTB) - the decision of the central bank to leave CTB to fail and to notify the prosecution of the possibility the main shareholder in the bank, Tsvetan Vasilev, to have stolen almost 103 million euros before the BNB took control over the bank.

The decision to join the banking union is indisputably great, but there are several shortcomings. First is that such a decision requires broad political consensus not only the agreement of those parties who are currently in parliament, especially bearing in mind that they have already agreed early elections to take place on October 5th, because broader consensus will avoid a scenario where a government in the future decides to withdraw the application or from the union. Second, the membership in the banking union will not at all resolve problems that stem from non-implementation of the commitments under the Cooperation and Verification Mechanism (CVM) because the CTB case is not at all banking in nature but is created by the lack of rule of law and the creation of a state within the state. The majority owner of CTB is Tsvetan Vasilev who is known in Bulgarian society as a sponsor of a huge media empire led by the scandalously known Delyan Peevski, nominated last year to head the State Agency for National Security (DANS) which unleashed unprecedented in scale and duration protests in Bulgaria.

The media empire managed in a short time to destroy the fragile democratic foundations, hesitantly built during a painful and difficult transition of the country from totalitarian rule toward democracy and membership in the EU and its values. All this before the eyes of the state and its regulatory bodies. In addition, CTB was until recently the bank of the state-owned companies where, even today, certain amounts of public money are still held. Until last year, a significant part of the public money was held precisely in this bank which enjoyed protection by three consecutive governments. The problems with CTB have started when two eminent oligarchs - Delyan Peevski and Tsvetan Vasilev - turned their partnership into a war and that is a problem that falls entirely under the scope of the CVM. The problems in the banking system are just a consequence of that war. From this point of view, Bulgaria should first liberate the state from the oligarchy and vested interests, cure the media environment and launch real reforms aimed at establishing genuine, not a facade democracy. Only then it may think about deeper integration with the EU (the banking union, the euro area, Schengen).

Why?

Because the foundation of stability of the banking system, but also of the euro area, is confidence as the crisis in the past five years has shown very clearly. Bulgaria has demonstrated in the first seven years of its EU membership that it cannot be trusted. And after the artificial crisis with CTB it is more than clear now that the only pillar of stability in the country - the banking system - cannot be trusted either. So, the decision of the political leaders and the president to urgently move toward accession in the banking union would have been a great decision if it was made, let's say, a year or two ago. Now it sounds more than irrelevant because a solution is sought where, if available at all, it would only be partial. A fully fledged solution can be found in the CVM - implement the recommendations, restore confidence both with EU partners and local citizens. However, not in the same order - citizens first and then the EU institutions and peers. The reality, though, is that this cannot happen with these political leaders because it was them who contributed with their actions or inactions for the current situation.

What is the banking union?

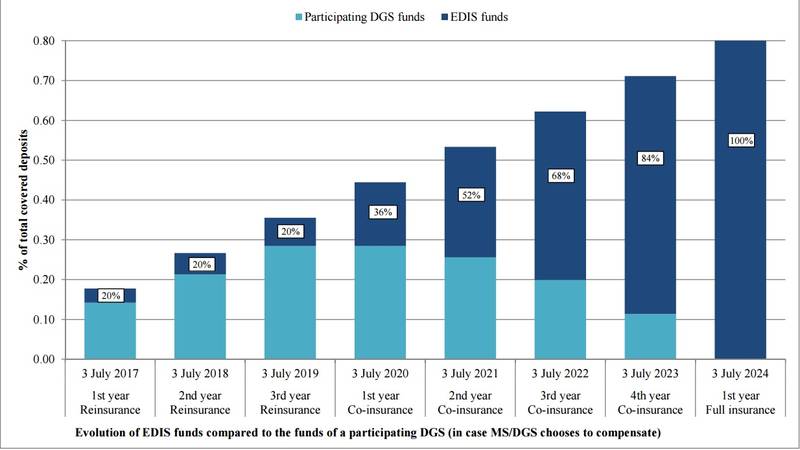

The construction of the banking union has started with a decision by the heads of state or government in June 2012. Its major goal is to break the vicious circle that formed in the beginning of the crisis in 2008 taxpayers to rescue banks that do not conduct prudential financial policies. The banking union consists, at this stage, of three major pillars - the single supervisory mechanism, the single resolution mechanism and the deposit guarantee scheme. The purpose of the first pillar which the parliamentary parties in Bulgaria aim for, is to detect in time, at central EU level, when or whether a bank is about to fail or to have financial troubles so that a spill-over can be avoided, thus protecting the entire system (national, eurozone or European-wide).

As the banks in the euro area are a little over six thousand, the ECB is incapable to exercise direct supervision over all of them. That is why, it will monitor closely and on a daily basis only those that are defined as systemic. This means that if they fail they could cause a serious crisis. In national terms, such a systemic risk posed the panic withdrawal of deposits from First Investment Bank (FiB) recently after CTB was closed. The panic, for that matter, was provoked by actions that, too, are treated by the CVM - to investigate and isolate the sources of distribution of harmful rumours which means the law enforcement bodies to work impartially to protect citizens and the public interest. Then there was a real threat for the entire financial system in the country. At European level, though, as systemic are understood banks that possess assets worth more than 30 billion euros or their size exceeds 20% of the country's gross domestic product. They are systemic for the common currency not only nationally.

ECB will also supervise directly and on a daily basis banks that have asked or have received direct public assistance from the euro area facilities as is the case of Spain. The other banks, including those outside the euro area, will be supervised by the national supervisory authorities. This means that they will continue to be responsible for the supervision of credit institutions from third countries that have opened branches or provide trans-border services in the EU. And here comes the first sobering from the euphoria that membership in the banking union will be a panacea for cases like CTB.

All non-euro area countries can state with the ECB their intention to join the supervisory mechanism by establishing close cooperation between the competent national authorities and ECB. For the purpose, the national competent authorities (BNB, the Commission for Financial Supervision) should undertake the necessary measures to ensure that they will comply with the relevant ECB provisions. How will this happen given the complete lack of confidence, especially in the past days, when it became clear that none of the two institutions did its work to prevent the crisis. And there is no way to do it because, again, this is a crisis that stems from the lack of rule of law, it is not a purely banking problem.

What is interesting in the political leader's decision in Bulgaria is that they state an intention the country to join only the first pillar, not the second although the two are closely intertwined. The second pillar is the mechanism for resolution of ailing banks. It is a step after supervision because if supervision finds out that a bank has troubles the second pillar provides a solution - either the bank to be rescued, restructured or to be left to fail without endangering the entire system. The second mechanism is much more complicated because it involves a common fund which is to cover the costs for resolution and it is thanks to that fund that the vicious circle is broken - taxpayers to pay the price for the mistakes of financial institutions or the competent authorities. The resolution mechanism consists of a regulation, a directive and an intergovernmental agreement. The directive affects all the EU member states while the regulation (the mechanism itself) and the intergovernmental agreement affect only the euro area countries and those outside who want to participate.

The supervisory mechanism has been finally approved in September last year and will become operational as of November this year as the ECB will gradually take over its functions. Currently, the bank is conducting asset quality reviews of 128 banks to check their stability before taking over its supervisory role. These checks are considered as the first huge test for the good functioning of the banking union as a whole. The resolution mechanism has been agreed after very tough negotiations this spring. It starts functioning as of January 1st, 2015 when the participating countries are expected to begin drawing resolution plans, gathering information and coordination among the national authorities competent for resolution. As of January 1st, 2016, the second phase of the mechanism is planned to begin which affects early intervention, resolution actions, including bail-in (by shareholders and creditors). It is true that the second pillar is still in a process of construction but the legal framework is already agreed and is currently being implemented. So, if Bulgaria wants deeper integration it is only natural to go for that pillar too.

How broad a consensus is there in Bulgaria?

Generally, in Bulgaria, the EU issues, even so significant as the banking union, rarely enter the public debates. So far, two consecutive governments expressed completely opposite positions on the issue of Bulgaria's participation in the banking union. When the leaders of the member states started discussing the union in 2012, the then Bulgarian Prime Minister Boyko Borissov said: "As a financially disciplined country in Europe Bulgaria has always insisted on a single centralised banking supervision in the European Central Bank". Borissov underscored that every country that participates in the banking union, no matter if it is a euro area member or not, should have an equal voice to the voices of Germany, France or Greece. According to him, "the integration of the banking sector will bring the necessary stability and growth to the country and is a big guarantee that there will be no failing banks".

In December 2013, when an agreement was reached on the second pillar of the banking union, Bulgaria was represented by Plamen Oresharski who then announced that the country has no interest in participating in the banking union. "It's good to be in but only if we will be able to take advantage of all the extras from being a member. And when some of the extras are only for the euro area members, there is not much need. In any case, to us the experience is interesting because one day we will be in. So, we're following it closely", said the prime minster who is expected to resign next week to open way for early elections scheduled for October 5th as the agreement between these same parliamentary  parties states and was sealed two weeks ago. However, neither Boyko Borissov nor Plamen Oresharski initiated any debate in the parliament on this issue.

parties states and was sealed two weeks ago. However, neither Boyko Borissov nor Plamen Oresharski initiated any debate in the parliament on this issue.

The prevailing attitude in Bulgaria is that the moment is not ripe for entering both the banking union or the euro area because this would mean additional financial burdening for the country. In other words, Bulgaria refuses to show solidarity or, at least, not until it needs solidarity itself. The previous government, that of Boyko Borissov, elected in 2009, had the euro area membership as a top priority. But then the euro area debt crisis broke and this forced many non-euro countries to postpone their accession to avoid bailing their partners out. Only Latvia decided that it is of strategic (and rather political) interest to be as integrated as possible with the EU. The country has fulfilled all criteria and introduced the single currency as of January 1st this year. Lithuania is also ready and is expected to follow suit on January 1 next year, thus becoming the second country to join the euro during the crisis.

No system can work well without a rule of law

Regardless whether consensus for Bulgaria's integration with the European core will expand, a major priority should be to establish rule of law and to grow respect for it. Otherwise, neither membership in the banking union nor membership in the euro area will help when the reasons for a crisis are the lack of confidence in the system or when the system is captured by vested interests. That is why, I would not be surprised if the same (tacit) criteria are imposed on membership in the banking union as on Schengen accession because both systems are based on trust.

As much as I am a staunch supporter of the deepest possible integration of Bulgaria into the EU, I think that, first and foremost, the broadest possible national consensus should be reached, including by parliamentary parties, on the urgent implementation of all the commitments under the CVM and only then to move ahead with accession in the banking union, Schengen and the euro area. This would show that Bulgaria truly means to restore confidence. Otherwise, it looks more like sweeping the problems under the EU's carpet. However, this is a time bomb and the case of Greece's hair dressed statistical data that helped the country join the euro area, prove that. Yes, it is true that Greece's membership in the euro area in the end led to the reforms that were due for decades, but we all know how high the costs were and Bulgaria has already paid them ... several times. There are no reasons for concerns that it would be harmful for Bulgaria to join the banking union while not being a member of the euro area because it practically is - the national currency is pegged to the euro and the banking market is to a large extent owned by eurozone banks.

In this regard, it should be noted that the European Commission recommended Croatia in its first country-specific recommendations, the country to conduct stress tests and asset quality reviews of all its banks that are not owned by euro area banks in parallel to those the ECB is conducting because these banks could create problems nationally. The logic behind this recommendation is that a possible banking crisis might spill-over to affiliates of euro area banks thus expanding the problem. Such a risk exists in Bulgaria as well. But, again, it is created by the lack of rule of law not by objective economic and political factors as is the Croatian case.

There is another argument why Bulgaria is better to start working on restoring confidence because its abscence is the main reason why Standard & Poor's, the credit rating agency, downgraded Bulgaria's rating. In the beginning of June, the agency decided to downgrade the long-term and short-term rating of the country from BBB/A-2 to BBB-/A-3. The motives are that the political environment in Bulgaria continues to be a challenge for the implementation of reforms necessary to tackle the "deep-rooted institutional and economic problems". The lack of "meaningful reform progress, we expect growth to remain lackluster and unemployment high". So, to me, the decision to join the banking union is in fact a transfer of the problems from the sick head onto the healthy head and I hope that, for the sake of the crucial importance of a success of the banking union for the very survival of the EU in general and the euro area in particular, Bulgaria not to be allowed in before it has proved that it is determined to turn the page. Something which political will has not been stated of neither at consultations with the president nor elsewhere.

Elke Koenig | © European Commission

Elke Koenig | © European Commission | © European Commission

| © European Commission | © European Parliament

| © European Parliament