Finally a Compromise about the Banking Union's 2nd Pillar which Finds EU Treaties Completely Exhausted

Adelina Marini, April 9, 2014

The good news with which the spring began in the European Union is that, finally, an agreement has been reached on the second pillar of the banking union - the single resolution mechanism (SRM) for failing banks - which is to undergo final approval by the European Parliament at its last plenary session in April before the European elections. The bad news, however, is that this agreement has reached the limits of the EU founding treaties. Precisely on the day of the astronomic spring (March 20), early in the morning, the negotiations between the Council and the European Parliament ended right on time for the spring EU summit on March 20-21 when the agreement got a formal approval. Each of the parties made concessions, but the biggest compromise was made with the EU treaties.

The good news with which the spring began in the European Union is that, finally, an agreement has been reached on the second pillar of the banking union - the single resolution mechanism (SRM) for failing banks - which is to undergo final approval by the European Parliament at its last plenary session in April before the European elections. The bad news, however, is that this agreement has reached the limits of the EU founding treaties. Precisely on the day of the astronomic spring (March 20), early in the morning, the negotiations between the Council and the European Parliament ended right on time for the spring EU summit on March 20-21 when the agreement got a formal approval. Each of the parties made concessions, but the biggest compromise was made with the EU treaties.

An agreement worth 55 billion euros

Now, beside a single supervisory mechanism, the agreement for which was as difficult, the banking union will have a body that will take decisions on the resolution or closing of a troubled bank and in the coming years there will be a fund, too, which will finance such operations. Unlike the supervisory mechanism though, the second pillar unveiled serious problems, especially from a legal point of view. The outcome is a complex hybrid between community legislation and intergovernmental arrangements. In case of future crises, the European Central Bank, in its capacity of a supervisor, will notify whether a bank is failing or is about to fail. On the basis of that notification, the single resolution board, which is to be established, will adopt a resolution scheme and will choose the tools to be applied for the purpose of resolution and will also take the decision about the use of the single resolution fund.

In the struck deal, it is envisaged the board to be able to decide if a bank needs resolution on its own initiative. Key for the efficient work of the second pillar is the speed with which the decision will be taken after the notification that a bank has trouble. The resolution scheme is planned to enter into force within 24 hours from its approval by the board, unless the Council (the finance ministers) reject it via simple majority upon a proposal by the European Commission. Within 12 hours from the scheme's approval by the board, the Commission could propose to the Council to reject the resolutions scheme because it is not in public interest or to change some of the elements of the decision.

The board will be responsible also for the resolution of cross-border banks and all those institutions which the ECB supervises directly. For all the rest care will take the national resolution authorities. The board, however, is responsible in all cases when a decision is to be taken on whether to be used money from the common fund. The national resolution bodies commit to apply the planned resolution schemes under instructions from the board. If a national body does not respect the board's decision then the it will be circumvented and the decision will be imposed directly on the troubled bank.

The board will consist of a chairperson, four full-time members and representatives of the national resolution authorities of the participating countries (all countries that participate in the supervisory mechanism - eurozone+). ECB and the Commission will have one representative each in the board who will play the role of permanent observers. The board will work in a plenary session (the chairperson, the four permanent members and the national representatives) or in the executive format (the chairperson and the four full-time members only). Which format will prevail over the other was one fo the most controversial points during the trilateral negotiations (trialogue). According to the struck deal, most of the draft resolution decisions will be prepared by the executive board and the representatives of the affected member countries will participate only with particular decisions.

The plenary session will be responsible for individual decisions that require five billion euros in capital or 10 billion euros in cash from the common fund. The plenary will also monitor the implementation of the resolution scheme and, most of all, how the money from the common fund is spent. When decisions are necessary for sums bigger than these thresholds, they will be taken by a simple majority by the board members in the plenary if they represent at least 30% of the contributions to the fund. The plenary session (with the member states' representatives) will give a green light to the fund to borrow and to collect additional funds on the financial markets. The transfer of key decisions to the plenary session is a cause of serious concern about how efficient the work of the board will be.

The plenary session will be responsible for individual decisions that require five billion euros in capital or 10 billion euros in cash from the common fund. The plenary will also monitor the implementation of the resolution scheme and, most of all, how the money from the common fund is spent. When decisions are necessary for sums bigger than these thresholds, they will be taken by a simple majority by the board members in the plenary if they represent at least 30% of the contributions to the fund. The plenary session (with the member states' representatives) will give a green light to the fund to borrow and to collect additional funds on the financial markets. The transfer of key decisions to the plenary session is a cause of serious concern about how efficient the work of the board will be.

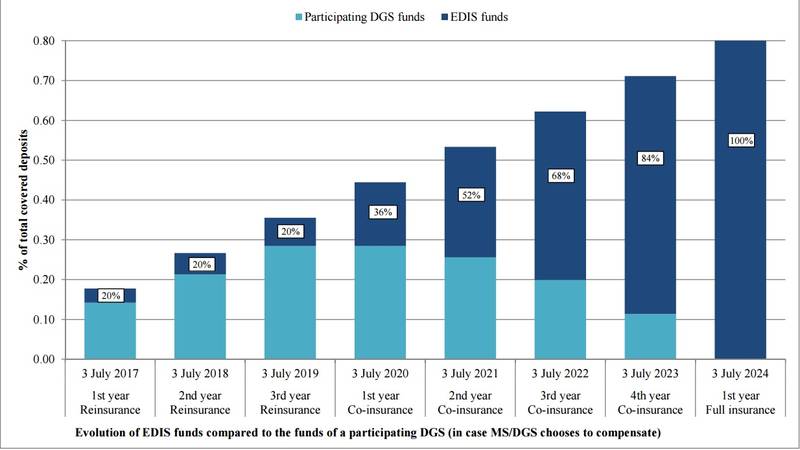

The other highly controversial element was the single fund. It will be topped up in the course of eight years, not ten as initially planned, until it reaches 1% of the covered deposits of all credit institutions in all the member states in the banking union. It is estimated that this will be around 55 billion euros. The money will be collected via bank levies the size of which will be calculated on the basis of the banks' liabilities and risk levels. The big problem, however, is how to finance operations that might occur before the fund is filled up. The decision that was reached after very difficult negotiations is each country to collect the bank levies in a national fund, called national compartment (some countries already have such). Gradually, the national compartments will combine their money until a complete merge into the common fund is reached (mutualisation).

The mutualisation begins in the first year when 40% of the money from the national compartments will be transferred. In the second year, another 20% will be transferred. Then the transfers will be equal until the fund is completely mutualised. This is one of the biggest victories of the European Parliament which insisted very much on a faster mutualisation. This is somewhat a Pyrrhic victory, though, because this is precisely the issue that has been exported into an intergovernmental agreement which is still not finalised. It will work in parallel with the single resolution mechanism regulation.

In the intergovernmental agreement, it is also envisaged, during the initial phase of filling of the fund, bridge financing to be secured that will be a combination of national resources (budget money), bank levies or money from the euro area permanent bailout fund (ESM). Also possible are temporary transfers from the national compartments. The finance ministers will sign a declaration with which they will commit to abide with the bail-in rules introduced with the approved in December bank recovery and resolution directive (BRRD). If a country does not sign the declaration, it will not have access to the fund.

The entire organisational part of the agreement - the board, the cooperation with national authorities, etc. - will enter into force on January 1st, 2015. The part which affects the early intervention, resolution actions and bail-in, will begin to be applied as of January 1st, 2016 if, of course, all conditions for the transfer of contributions to the fund are met. The intergovernmental part of the deal is  planned to take effect when it is ratified by the member countries of the banking union who represent 90% of the weighted votes of all the member states.

planned to take effect when it is ratified by the member countries of the banking union who represent 90% of the weighted votes of all the member states.

A happy end for the European Parliament

The MEPs have reasons to celebrate and open the champagne, although they did not achieve concessions on all their demands. According to the main rapporteur on the second pillar of the banking union, the Portuguese Elisa Ferreira (Socialists&Democrats), the parliament has gained a lot. The biggest loss, however, remains the intergovernmental agreement. "We wanted specifically the intergovernmental agreement to be politically addressed because the intergovernmental approach in a competition with the community method is something we cannot tolerate", she said at the joint press conference with the other participants in the Parliament's negotiating team - the German Sven Giegold (Greens/EFA), Sylvie Goulard (France, ALDE), Corien Wortmann-Kool (The Netherlands, EPP). This team, by the way, is the backbone of the economic committee of the European Parliament, which played a crucial role throughout the entire term of the current parliament marked by the eurozone crisis.

Elisa Ferreira called the deal "interesting" and added that it ensures that there will be a single resolution mechanism in whose work there will be no political interference. Her colleague from ALDE, Sylvie Goulard, said that the struck deal has revealed "a new dimension of democracy". In the beginning, she said, many journalists wrote that the agreement reached in December in the Council was The deal, but this was not the end of the procedure. And as the banking union is perceived in Strasbourg as an emanation of the powers of the European Parliament, enhanced with the Lisbon Treaty, the MEPs did not hide their joy that this will be written in their CVs for the EU elections in May. "We did the job for which the voters sent us here", the French MEP added. She called against seeking the downsides of the deal because in the beginning of the parliamentary term no one was capable of even believing that today the EU would have a single supervisory mechanism and a single resolution mechanism.

The problem is, though, she added, that "We have more or less reached the limits of what we can achieve with these treaties and this construction. The fact that we need an intergovernmental agreement in the field of co-decision is something that was not foreseen in the treaties, how do we combine the requirements of new legislation for the eurozone and the legislative powers of the this parliament", Sylvie Goulard explained, thus supporting the cause of the German finance minister for treaty changes that will allow the deepening of the integration in the area of the common currency.

To Sven Giegold the deal was a triumph of parliament over Wolfgang Schäuble (the German finance minister). "The parliament is not powerless. We can wake up Mr Schäuble in 5.30 in the night and he then actually concedes", he said with satisfaction. This remark might seem like a petty nagging, but, in fact, it is a key because the German finance minister demonstrated throughout the trialogue complete ignoring for the European Parliament and its most important function - to make the legislative process more transparent.

To Sven Giegold the deal was a triumph of parliament over Wolfgang Schäuble (the German finance minister). "The parliament is not powerless. We can wake up Mr Schäuble in 5.30 in the night and he then actually concedes", he said with satisfaction. This remark might seem like a petty nagging, but, in fact, it is a key because the German finance minister demonstrated throughout the trialogue complete ignoring for the European Parliament and its most important function - to make the legislative process more transparent.

A victory or a loss

It is still too early to say will the painfully achieved compromise and the complex structure be efficient enough when the need comes, but the deal raises another issue the solution of which has been avoided in the past years - the need of treaty changes. In this regard, the deal could be perceived as a victory but as a loss, too. The good thing is that the compromise came at a time when a reform of the treaties is being debated. The German finance minister even said that the debate will begin right after the European elections. So, this is not the end but just the beginning of the construction of a genuine European union.

Elke Koenig | © European Commission

Elke Koenig | © European Commission | © European Commission

| © European Commission | © European Parliament

| © European Parliament