Will Herman Van Rompuy's Economic and Monetary Union Be Genuine?

Adelina Marini, December 7, 2012

Precisely a week before another key European Council on December 13-14, the final report of the four presidents is ready and envisages the eurozone to turn into a "genuine" economic and monetary union (EMU) in three stages, with a common budget, a bank resolution fund, a deposit guarantee scheme, a single bank supervision and enhanced accountability. The chiefs of the ECB, the Commission, the European Council and the Eurogroup were tasked by the EU leaders on June 29th to prepare a detailed road map for a genuine EMU by the end of the year. Some of the elements of the map were discussed by the leaders at their autumn European Council in October, but in the mean time with own ideas came out one of the "presidents" - Jose Manuel Barroso - which are taken into account in the final document.

Precisely a week before another key European Council on December 13-14, the final report of the four presidents is ready and envisages the eurozone to turn into a "genuine" economic and monetary union (EMU) in three stages, with a common budget, a bank resolution fund, a deposit guarantee scheme, a single bank supervision and enhanced accountability. The chiefs of the ECB, the Commission, the European Council and the Eurogroup were tasked by the EU leaders on June 29th to prepare a detailed road map for a genuine EMU by the end of the year. Some of the elements of the map were discussed by the leaders at their autumn European Council in October, but in the mean time with own ideas came out one of the "presidents" - Jose Manuel Barroso - which are taken into account in the final document.

The three stages

Unlike Barroso's three phases, the three stages in the report of the Four are much shorter. The first stage is 1 year long and is planned to begin in the end of this and to continue throughout 2013, during which the process of enhancement of the economic governance is expected to continue - the well known six-pack, the Treaty on Stability, Coordination and Governance (the fiscal compact), the two-pack which is still in a legislative process. Separately, a framework for ex-ante coordination of big economic reforms is to be created, as envisaged in the fiscal compact; a single supervisory mechanism (SSM) has to be established for the banking sector; reaching an agreement for harmonisation of the frameworks for banks resolution through the permanent rescue fund of the eurozone (ESM).

The second phase is also one year long (2013-2014) and envisages completion of the integrated financial framework and a mechanism for closer coordination. At the moment, securing of the financial stability is based on national responsibilities which is contrary to the very high degree of integration in the euro area and, according to the report of the Four, has exacerbated significantly the interaction between the fragilities of the sovereign and the vulnerability of the banking sector. This is why, the report points out, the creation of the single banking supervision should be a guarantor for strict and unbiased supervision. That supervision must start functioning on the 1st of January 2014 and the preparatory work on it therefore is "imperative" to start in the beginning of 2013, the document reads. Something, which at this stage looks difficult.

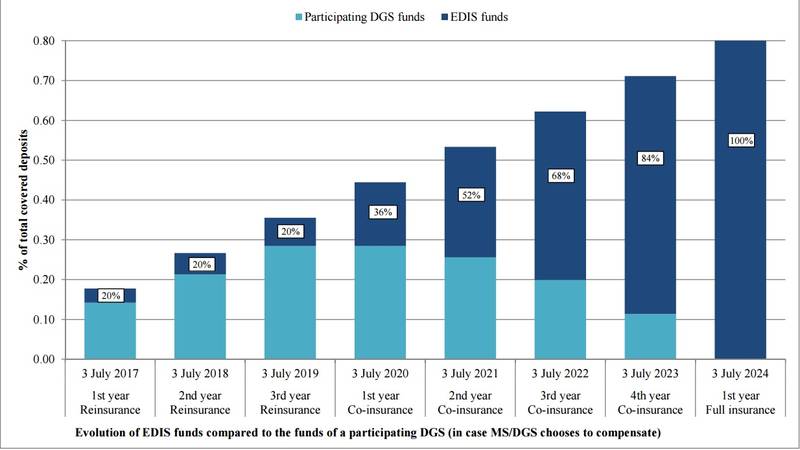

Van Rompuy's report points out that after the SSM begins functioning for the eurozone banks, then the permanent rescue fund of the eurozone (ESM) could take over the responsibility for direct bank recapitalisation. This, according to Rompuy, could happen on the basis of an ordinary decision. The foreseen deadlines, however, are worrying - the end of March 2013. In order for the integrated financial framework to be of full value, a single bank resolution authority needs to be created and appropriate measures have to be taken to ensure that taking a decision to rescue a bank will be fast, unbiased and in the interest of all. That authority must work at European level where the banking supervision is already functioning. The Commission committed to develop the foundations of the authority, but a condition for that is the adoption of the directives for bank resolution and deposit guarantees.

The formulation of the authority is not very clear in the Van Rompuy's proposal, especially in the context of the ECB. The text literally says the following: "This single resolution mechanism – built around a single resolution authority – should be

established as the ECB assumes its supervisory responsibility in full". It is only pointed out that the resolution mechanism should be based on strict governance arrangements, including guarantees for independence and accountability. The resolution mechanism is a supplement to the supervision mechanism to ensure that the troubled banks will be restructured and closed quickly without creating problems for the banking system. The supervision mechanism is expected to provide "timely and unbiased" assessment for the need of resolution and the resolution authority will ensure timely and effective resolution, is the vision of the four presidents.

The big question is how will the resolution mechanism be funded. In the document this is concisely written, probably because this issue is left for the summit next week to decide how exactly should this happen, but one option is financing to be organised through a credit line of ESM to the resolution authority. There is a hint for funding with public money, as the formulation for this is as follows: "This backstop should be fiscally-neutral over the medium-term, by ensuring that public assistance is recouped by means of ex post levies on the financial industry".

In parallel to this framework is envisaged the establishment of a mechanism for coordination, convergence and implementation of structural policies, based upon contracts between the member states and the European institutions. This will be a replacement of the adjustment programmes which are currently being implemented by the bailout countries and which were agreed by the EU and the IMF. The lessons from the rescue of Greece, Portugal, Ireland and also Spain's problems, seem to have been learnt because it is proposed the contracts to be prepared on a case-by-case basis. It is important to note that the financial assistance, accompanying the rescue contracts, will be separate from the multiannual financial framework. (the EU budget).

The third stage is with an open end and a beginning in 2014. In the report it is said that that stage will mark the culmination of the reform process "toward a genuine economic and monetary union", as the official name of the document goes. The main purpose of this stage is to improve the EMU sustainability through creation of an absorbing shocks function at central level. An essential element of this function is the so called fiscal capacity, which can be interpreted as a budget or a fund, whose purpose is to improve the absorption of specific national economic shocks through a system of insurances created at a central level. The fiscal capacity will be a supplement to the contracts for reforms from stage 2. According to the four presidents, if an incentives-based system is integrated this will motivate eurozone member states eligible for participation in the system for absorption of shocks to continue to pursue solid fiscal and structural policies, according to their commitments in the contract.

Rompuy's plan envisages the design of the function for shocks absorption to follow two approaches - a macroeconomic and a microeconomic. In the former option contributions and disbursements will depend on the fluctuations of the cyclical incomes and spending or the economic activity. The latter option will be more directly bound to specific public functions sensitive to the economic cycle, like for example unemployment insurances. In this case, the level of contributions in the fiscal capacity or disbursements will depend entirely on the development of the labour market. Then the fiscal capacity can even work as a supplement or a partial substitute to national unemployment insurance systems. But it is recommended the transfers to be limited to cyclical unemployment covering only short-term unemployment. With time, every euro area member state, during its economic cycle, will be a net receiver and a net contributor to the scheme.

The leading principles of the function for shocks absorption are the elements for risk-sharing not to lead to unidirectional and permanent transfers between the member states or to be perceived as a supplement to the incomes. The function should also not undermine the financial incentives in support of stable fiscal policy at national level or the incentives aimed at tackling structural weaknesses. The fiscal capacity must be part of the EU framework and its institutions. It should not be viewed as a crisis management tool because the permanent rescue fund of the eurozone has been created for this purpose.

The report proposes the financing of the fiscal capacity to happen through national contributions, own resources or a combination of both. In a long-term perspective, it is recommended the capacity to be able to borrow on the basis of common debt issuance. The integrated financial framework will require the creation of a treasury with clearly defined responsibilities, which is also set in Barroso's idea. It is explicitly pointed out, however, that it should be part of the EU and its institutions because in this way will be ensured the integrity of the existing fiscal framework of the EU and the procedures for coordination of economic policies. More details on this, however, are not mentioned. In Barroso's plan, it is envisaged the "treasury" to be part of the Commission and even for the purpose the Commission chief charged Olli Rehn's post with additional responsibility to oversee the eurozone.

For stage 3 is also envisaged to move towards common decision-making for the national budgets and for enhancing economic coordination, especially in the area of taxation and employment. In this regard, the report says, the Commission vision is a foundation for debate. In Barroso's blueprint, quite specifically is referred to a eurozone budget but not in the sense of a financial framework with which the EU has been working for decades, rather something closer to national budgets. The issue in Rompuy's report is left open which means it is left to the leaders to agree on the details if they accept the thesis at all.

And regarding the democratic legitimacy and accountability, the report of the four presidents sides with Germany that to happen where decisions are taken. This means, the report says, that the European Parliament participation will be for the accountability for decisions taken at European level, while national parliaments will keep their pivotal role. Regarding the integrated financial framework, the accountability is expected from the ECB as a single supervisor at European level, but with the assistance of strong mechanisms to provide information, reporting and transparency before national parliaments of the participating countries.

Is Rompuy's/the Four's plan realistic?

It is hard to say at this stage because he leaves the most contentious points to the leaders. The time frames are quite realistic given that there is political will. Phase 1 is completely realistic because e large part of it is already a fact and is working. The problematic areas in it are the supervision mechanism for the banks, the direct recapitalisation of banks through the permanent fund, the deposit guarantee schemes and the banks resolution fund. But if the leaders agree, the legislative work could end in the course of 2013. And will they agree we will see on December 13-14. Barroso's observations, and no only his, show that the leaders have started to significantly retreat from the ambition they demonstrated in June and that on that ambition depends how "genuine" the economic and monetary union Van Rompuy proposes will be.

| © The Council of the European Union

| © The Council of the European Union | © European Parliament

| © European Parliament Klaus Regling | © Council of the EU

Klaus Regling | © Council of the EU Mario Centeno | © Council of the EU

Mario Centeno | © Council of the EU Mario Centeno | © Council of the EU

Mario Centeno | © Council of the EU Elke Koenig | © European Commission

Elke Koenig | © European Commission | © European Commission

| © European Commission | © EU

| © EU | © European Parliament

| © European Parliament