Ideological Clash in ECOFIN on the Deposit Insurance Scheme

Adelina Marini, December 11, 2015

A real verbal shootout exploded between the ECB and Germany on December 8th, when the Council of finance and economy ministers of the EU (ECOFIN) discussed for the first time the proposal of the European Commission regarding the third pillar of the banking union – the European Deposit Insurance Scheme (EDIS). The subject of a common European Deposit Guarantee Scheme (DGS) is taboo for German Finance Minister Wolfgang Schäuble, who repeatedly warned the Commission to spare itself the effort of drafting a proposal, which Berlin will dismiss as groundless. The Commission of Jean-Claude Juncker (Luxembourg, EPP), however, is firmly set on keeping its pre-election promises and follow the guidelines, set in the five presidents’ report on deepening the euro area. At the end of November, the EC presented something it sees as more acceptable than the Guarantee Scheme – an insurance scheme.

A real verbal shootout exploded between the ECB and Germany on December 8th, when the Council of finance and economy ministers of the EU (ECOFIN) discussed for the first time the proposal of the European Commission regarding the third pillar of the banking union – the European Deposit Insurance Scheme (EDIS). The subject of a common European Deposit Guarantee Scheme (DGS) is taboo for German Finance Minister Wolfgang Schäuble, who repeatedly warned the Commission to spare itself the effort of drafting a proposal, which Berlin will dismiss as groundless. The Commission of Jean-Claude Juncker (Luxembourg, EPP), however, is firmly set on keeping its pre-election promises and follow the guidelines, set in the five presidents’ report on deepening the euro area. At the end of November, the EC presented something it sees as more acceptable than the Guarantee Scheme – an insurance scheme.

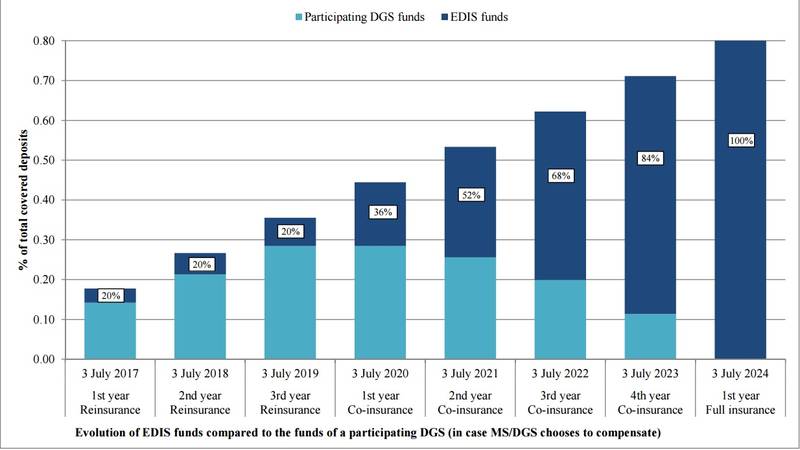

It is actually the first stage of a potential future guarantee scheme, which would unfold in three phases. The first one is re-insurance. The EC envisages within the next three years (by 2020) national DSGs being able to access funds from the European scheme only when they have exhausted their own resources and provided they meet the requirements. At this first stage, risk remains at the national level. The second phase is co-insurance and it will start after the first one ends. National schemes will be able to utilise funds from EDIS without having depleted their own resources first. This is a step towards sharing the risk. According to the EC, the contribution of EDIS will start at 20% and will gradually grow over the next four years.

The third phase is full deposit insurance, which is projected to commence from 2024. The timing is selected so that it coincides with the final deadline for merger of national bank resolution funds into a European Single Resolution Fund. Germany’s biggest concern is that a common DGS creates moral hazard. The EC insists that all necessary prevention measures are taken. Over the next weeks a full package of risk aversion measures is about to be presented. The EC vice-president in charge of the euro and the banking union, Valdis Dombrovskis (Latvia, EPP), reassured the ministers during the public discussion on December 8th that the scheme will be applicable only to the states, which have met their commitments on financing the European Single Resolution Fund.

Commissioner for Financial Services Jonathan Hill (Great Britain, ECR), assured that the scheme will bring no additional expenses to banks. The riskier banks will pay higher premiums, than the more cautious banks. No funds will be released from EDIS if all contributions are not paid.

Germany wants urgent changes in treaties because of the ECB

Speaking for the ECB in the public discussion was Vitor Constâncio. He welcomed the Commission’s initiative for completing the banking union. He feels the third pillar is mandatory, considering at the European level there is already banking supervision and resolution of failing banks. He criticised current European legislation, which allows excessive levels of national discretion in the harmonisation and implementation of some rules, for this obstructs the introduction of a common supervisory culture and true level playing field regarding supervision. Vitor Constâncio pleaded that this important element is taken into consideration when this legislation is reviewed. In conclusion, he urged the EC to prepare proposals for convergence of rules concerning bankruptcy, for they are in the basis of effective fight against “the big problem of excessive NPLs”.

Wolfgang Schäuble took the stage right after him and went on to strongly attacking the ECB for overstepping its functions. He recalled his worries of three years back, when the negotiations on the first pillar of the banking union – the Single Supervisory Mechanism - were going on. Back then Germany objected to the ECB being responsible both for the monetary policy and bank supervision. Although back then he agreed to compromise, Mr Schäuble got annoyed by Vitor Constâncio’s speech and pointed out again that a “Chinese wall” needs to be built between the supervisory functions of the bank and its monetary policy. “We need urgently an amendment to the treaty to divide the ECB functions”. The German finance minister implored that first of all the contributions in the SRF need to start accumulating and the next step should be to see in practise exactly how the bank bail-in option will work, it being an important element of the SRM.

Wolfgang Schäuble took the stage right after him and went on to strongly attacking the ECB for overstepping its functions. He recalled his worries of three years back, when the negotiations on the first pillar of the banking union – the Single Supervisory Mechanism - were going on. Back then Germany objected to the ECB being responsible both for the monetary policy and bank supervision. Although back then he agreed to compromise, Mr Schäuble got annoyed by Vitor Constâncio’s speech and pointed out again that a “Chinese wall” needs to be built between the supervisory functions of the bank and its monetary policy. “We need urgently an amendment to the treaty to divide the ECB functions”. The German finance minister implored that first of all the contributions in the SRF need to start accumulating and the next step should be to see in practise exactly how the bank bail-in option will work, it being an important element of the SRM.

The next step, according to Mr Schäuble, needs to be reducing the sovereign risk on bank balance sheets. Only then there can be discussion of risk sharing. Because, he said, risk sharing is an obstacle for risk reduction. Wolfgang Schäuble again pulled out the legal card, as he did in the discussions of the first and second pillars of the banking union, stating that article 114 of the Treaty is not a sufficient legal basis for creating EDIS. “We will not accept it by any way, unless we have an amended [legal base]”, he said. Only, at this stage, Germany is not inclined to open the treaties for amendments.

Italian Finance Minister Pier Carlo Padoan differed by saying that there were no obstacles to risk sharing and reduction going hand in hand, for this would send a clear signal to market operators and governments. Padoan is convinced that the third pillar of the banking union is the final and necessary step for its completion. In his words, the EC’s proposal for gradual transition towards risk sharing is a good approach. Support for the proposal came from Spain as well. Finance Minister Luis De Guindos stated that no table can keep its balance on two legs only. It needs three. He feels the Commission’s proposal is a good starting point for debate. Luis De Guindos too sees no problem in going parallel towards risk sharing and risk reduction.

Austria is sceptical towards the EDIS for the same reasons as Germany – lack of trust regarding security of deposits. And the problem is in the timing. Austria is not sure what sort of a signal will be sent right at this moment. Greek Finance Minister Euclid Tsakalotos fully supported the proposal by making a provocative speech, underlining that the risk is two-way – if someone is borrowing too much, someone else is lending too much. The Belgian position is also one of full support. The moment is right now. This is an inherent part of the monetary union, said the permanent representative of the country to the EU, Dirk Wouters. States, which are not a part of the banking union, like the Czech Republic and Poland, also supported the proposal. The Czech Republic feels that it is important for the creation of a level playing field and avoiding moral hazard. The new Polish finance minister, Paweł Szałamacha, stated that, although not a participant in the banking union, Warsaw will be watching very closely whether the new scheme would not turn out to be detrimental to the country.

Dutch finance minister Jeroen Dijsselbloem, who will be taking over the rotating presidency of ECOFIN starting January 1st, proposed that a mandate is given for horizontal work in the workgroup, for the discussion showed that more clarity is needed regarding the essence of the proposal and timing. Although most of the ministers who spoke backed the EC’s proposal, with Ireland’s Michael Noonan even expressing disappointment, for Ireland has long insisted on full mutualisation, Germany’s resistance will be a key factor for accepting the proposal and the final look that it will have. So far, work on the first two pillars of the banking union has gone with extreme difficulty. The Single Supervisory Mechanism (SSM) was created relatively fast, albeit with many arguments.

The SRM proved to be much more complicated and the Treaty of Lisbon turned out to be not wide enough for it. This is why it came to a complex combination of community legislation and intergovernmental agreement. The fund itself is based on an intergovernmental agreement that has enough ratifications to be able to start work from January 1st. By all accounts, work on the third pillar will be extremely difficult as well. Whether an intergovernmental agreement will be the option of choice again in order to avoid amendments in the founding treaties is, as of yet, unclear. Although the first discussion in the Council on this subject started with a clash, it ended with laughter. Luxembourg Finance Minister Pierre Gramegna ended the discussion with a linguistic question how this dossier should be named – a third leg of the banking union, or a third pillar. “I strongly prefer pillars because with 3 legs is difficult to run”.

One of the arguments against the proposal, namely the timing, is linked to the fact that practically at the moment only the SSM is active. Restructuring starts January 1st and Bank Recovery and Resolution Directive is not yet adopted by all member states. The EC sent six member states to court for missing the deadlines for transposing the directive into their national legislation. Those are the Czech Republic, Luxembourg, The Netherlands, Poland, Romania, and Sweden. On December 10th, the EC warned ten members for not adopting the deposit guarantee directive – Belgium, Cyprus, Estonia, Greece, Italy, Luxembourg, Poland, Romania, Slovenia, and Sweden. According to Vitor Constâncio, the implementation of these directives is very important. The Single Resolution Fund was also threatened with not starting work on January 1st due to a very slow ratification process.

This is the reason there is not enough data accumulated yet to see how the new legislation is functioning in order to work on more legislative initiatives, like the EDIS.

Translated by Stanimir Stoev

Elke Koenig | © European Commission

Elke Koenig | © European Commission | © European Parliament

| © European Parliament | © European Commission

| © European Commission