The Western Balkan Economies - Informal, with Huge Unemployment and Unreforming

Adelina Marini, January 8, 2014

2013 has marked a new beginning in the European Commission's approach to the enlargement process. The eurozone crisis (and not only) was a leading issue in the past years for the reform of the economic governance of the European Union, because it revealed very serious flaws of the European integration process that either remained invisible in the periods of economic boom or were underestimated. With Croatia's EU accession last year with an economy in a five-year-long recession, the need of change of approach toward the candidate countries became imperative. In its enlargement strategy for 2014 the Commission envisages to introduce the European semester for the Western Balkan countries and Turkey.

2013 has marked a new beginning in the European Commission's approach to the enlargement process. The eurozone crisis (and not only) was a leading issue in the past years for the reform of the economic governance of the European Union, because it revealed very serious flaws of the European integration process that either remained invisible in the periods of economic boom or were underestimated. With Croatia's EU accession last year with an economy in a five-year-long recession, the need of change of approach toward the candidate countries became imperative. In its enlargement strategy for 2014 the Commission envisages to introduce the European semester for the Western Balkan countries and Turkey.

Although the candidate countries for EU membership had to fulfil the economic criteria approved by the European Council in Copenhagen in 1993, 20 years later it became clear that they are insufficient. And these criteria are the existence of a functioning market economy and a capacity to handle competitive pressures and the market forces in the EU. Almost all Western Balkan countries have no market economy status yet. In 1997, after a progress review, the Commission proposed several sub-criteria that specify the fundamental ones. Those are a balance between demand and supply in a context of free interplay of the market forces, including trade liberalisation; removal of barriers preventing the establishment of new firms and simplifying bankruptcy procedures; how does the legal system work in terms of property rights, how contracts are implemented and, generally, how does the judiciary work; macro economic stability, management of public finances; broad consensus on the main parameters of economic policy; condition of the financial sector.

It is precisely on the basis of these criteria that the Commission prepares the economic chapters in the progress reports of the candidate countries and also of those who aspire to set off on the path of European integration. As of this year, the reports are expected to change with an enhanced focus on the methodology for economic analysis established in the European semester. A little before the end of 2013, the economic and financial affairs general directorate of the European Commission took out the economic chapters from the annual progress reports and put them into a separate document, which offers a very good picture of the starting positions of the enlargement countries before they enter the European semester. This website offers you, however, the economic analyses only for the Western Balkan countries because Iceland has refused to continue its EU accession for now, and Turkey is very different and deserves a separate analysis.

The countries from former Yugoslavia and Albania have a lot of common problems, but also some differences, which are rather to be qualified as insignificant. All of them suffer from extremely high unemployment, especially among the young people, of widespread corruption, a growing public sector, unjustified optimism when planning the budget and, in general, of bad management of public finances. All of them are in one way or another affected by the crisis in Europe because their markets are to a lesser or greater extent integrated with the EU's single market. In general, the Commission's document reports that all have maintained their political consensus in terms of the fundamentals of the economic and fiscal policy, excluding Bosnia and Herzegovina. But the wording is rather non-specific.

Some countries introduced fiscal rules or are in a process of introducing such rules, but they are a few and there are no guarantees (national consensus) that these rules will not be abolished when convenient. For instance, Albania introduced a 60% debt ceiling of 60% as is the standard in EU's Stability and Growth Pact, but in December 2012 it abolished it and left the debt plunging dangerously. Serbia, too, has a limit of 45%, but has already exceeded it. That is why, it is necessary when applying the European semester methodology the existence of national consensus to be monitored with much more rigidity and specificity and to seek a political pact among the major political forces on key parameters.

This will face the political elites in the region with the serious challenge to have quite narrow spaces for competition among themselves, but this will force them to commit to a national interest as Croatia put it recently - to achieve economic prosperity. The common conclusion that can be drawn from the Commission's document, though, is that all countries from the region have weak fiscal discipline that is dependent on whether it is an election year or not.

All the six countries from the Western Balkans suffer from a huge share of the informal economy, as in Bosnia and Herzegovina and Kosovo the situation is especially severe. Another common thing is that there is a complete disharmony between what the education system produces and what the economy needs. The growing public debts and deficits do not suffice to satisfy the needs of the education system of funding which often is limited to only paying salaries. The weak fight with corruption and the weak rule of law also pose a serious impediment for the economic development of the countries in the region, as in all cases the Commission reports weak to some progress. It will be interesting to see how and whether there will be a change after the change of European Commission's approach to focus precisely on the rule of law and the fight against corruption throughout the entire negotiations process. This scheme debuted in Montenegro and is expected, in the end of January, to be applied in the negotiations framework with Serbia, too.

The size of the state varies from a country to country as it seems smallest in Macedonia and in Montenegro it is the biggest. The six register an increase of the non-performing loans in the banking sector, as the differences stem from which types of credits are predominantly non-performing - for households or corporates.

Macedonia focuses more on decorating its capital than on reforms

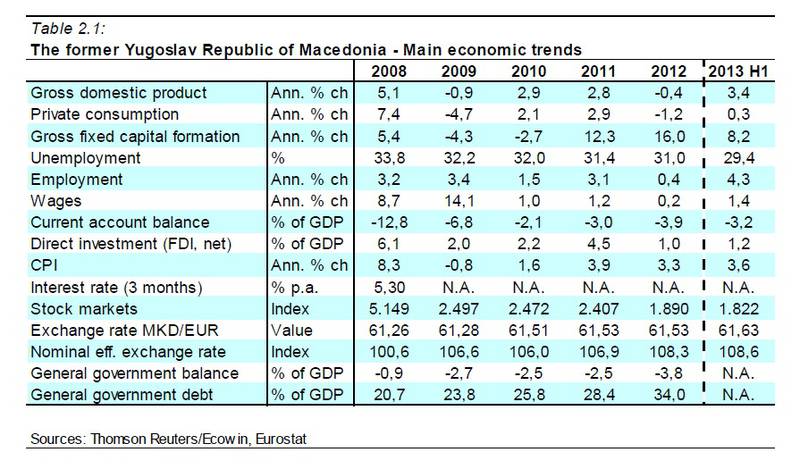

Macedonia is one of the poorest in the region with an average income per capita, measured by purchasing power standards, of 35% below the EU27 average (the analysis was made before Croatia joined in the EU on July 1st, 2013). The analysis points out, however, that this level was maintained, which means that in 2012 there was no change in the purchasing power of the Macedonians.

Macedonia has a relatively good macro economic picture. Although the EU reports that the external imbalances increased in 2012, they still are 3.9% as the increase is from 3% in 2011. The reason is  mainly in the trade deficit which has reached 24 per cent of the GDP and is funded mainly by credit because the net foreign direct investments declined in 2012 by two thirds to 1.4% of GDP.

mainly in the trade deficit which has reached 24 per cent of the GDP and is funded mainly by credit because the net foreign direct investments declined in 2012 by two thirds to 1.4% of GDP.

Unemployment, however, continues to be very high, especially among the young people. In June 2013 the overall unemployment was 28.8% which lines the country up with the most severely affected countries in Europe. Croatia, for instance, is third after Greece and Spain. Youth unemployment in Macedonia is also huge, right in the Greece's and Spain's category - 51.7 per cent - although 2012 marks a decline compared to the previous year when the young unemployed had a 54.9% share in the overall unemployment. The share of the employed in the public sector is 25% of the overall employment, which is solid, although the Commission believes the role of the state in the economy is limited.

Macedonia is not doing very well with the management of its public finances. The budget deficit has reached 3.8% in 2012. In 2013 the predictions of the government in Skopje about the budget hole also proved to be too optimistic. According to the Commission, the management of the public finances is quite chaotic and is not aimed at structural changes. This creates an environment of uncertainty, further deteriorated by the quick debt growth which still is relatively low - in 2012 it was 27.8% and in 2011 it was 24,4%, but by July 2013 it jumps to 33.6% of GDP.

Instead of reducing the state-owned companies, Macedonia is increasing them. In 2012, the entirely state-owned companies have grown from 12 to 15 after a restructuring of the public sector. A large part of the state capital, however, is heavily concentrated in five companies which are mainly utility. The banking sector is generally stable, but the share of the non-performing credits increased from 10 percent in 2012 to 12.3% in the end of June 2013. The corporate loans have a predominant share in non-performing than the loans for households.

The Commission recommends the country to improve the infrastructure and quality of education at all levels, but notes that spending is insufficiently concentrated on building a knowledge-based society, but instead "is used for less productive purposes, such as the decoration of the capital". It is also recommended the fiscal policy to be brought in line with the priorities for structural reforms, to improve strategic planning and also to stick to fiscal discipline. The informal economy is also a very important challenge, are the Commission conclusions for Macedonia, which has a candidate status but is not negotiating for accession because of Greece's veto.

Montenegro - a small country with a huge state

The tiny Balkan nation is already negotiating with the Commission and is the first to be applied the reverse method of negotiations - first to begin with the most difficult chapters in the negotiations process. Those are chapters 23 and 24 that cover the rule of law and fundamental rights. And although those are really very serious challenges, the economic analysis shows that the economy, too, needs very serious attention. Moreover, bearing in mind that it is in high dependence on Russia which, as experience in the eastern block shows, is not a recipe for economic prosperity. Montenegro, entered a recession in 2012 after two years of "modest" growth which is an euphemism of a level of economic expansion that is far  beyond the country's potential. The economy shrank by 2.5%, but recovered slightly in 2013 to reveal its dependence on external demand.

beyond the country's potential. The economy shrank by 2.5%, but recovered slightly in 2013 to reveal its dependence on external demand.

Unemployment in this former Yugoslav republic as well is among the highest - almost 20% - and is without change since 2010. An interesting fact is that there are some regional disparities. For example, in the coastal and central regions of the country of 600 thousand the level of unemployment is from 10 to 15.6%, but in the northern part the number of unemployed jumps to 36.7%. It is pointed out that the long-term unemployment remains a serious concern because 69 per cent of the jobless are without work for more than two years. The young unemployed (15-24 years of age) have a 40 per cent share in the overall unemployment in the country.

Montenegro's fiscal policy is also very instable and, according to the report, the multilateral introduction of the euro shows that the government has a very narrow space to conduct monetary policy. Montenegro's budget deficit remains high and in 2012 it was 5.6% of GDP, which is well above the set target in the budget - 2.4%, revealing serious problems with budgeting in Podgorica, as in all the other capitals in the Western Balkans. In an attempt to impose on itself fiscal discipline, the Montenegrin government proposed in July the introduction of a fiscal rule which is valid for the EU, too - a 3% budget deficit and no more than 60% public debt. The draft law, however, is not yet approved by Parliament. It envisages the establishment of an independent fiscal council that will evaluate the government's economic and fiscal policies, as is set in the fiscal compact, which most of the EU member states signed two years ago. The size of the government is huge, compared to other countries in the region - 47% of GDP. It has grown from 45 per cent in 2011.

Montenegro's government debt is also worrying because in 2012 it increased to 54 per cent of the gross domestic product. A huge burden for the budget are more than 30 companies with majority state-owned stakes. The process of privatisation, however, is going very slowly. Montenegro's economy is undergoing a process of restructuring from production (mainly of aluminium) toward energy. In general, the economy is shifting from production to services. Russia is the biggest investor in the country, while the EU is responsible for 50% of the investments. The EU's share in Montenegro's trade marked a decline in 2012 to 36.8% compared to 41.3 the previous year. Instead, the trade flows with the CEFTA countries are increasing.

Serbia - big and hesitating

This is the biggest economy in the region which also went through a recession in 2012, when it shrank by 1.7%. Unemployment in Serbia, too, has reached record heights of 23.9% as here, too, the youth and long-term unemployment are huge across the country. One of the main reasons the Commission revealed is the clumsy labour legislation. The fiscal discipline is also quite unstable. In the election year (2012), the government spending skyrocketed and entirely deleted the not very bold previous efforts for fiscal consolidation. The deficit instead of the expected 4.25% reached 6.4% of GDP, but without taking into account the money for bank recapitalisations and called guarantees. In 2013, the expectations, again, were far from reality. According to the Commission, the main problem is not only bad budgetary planning, but also the inefficiency of spending and the high spending on wages and pensions.

This is the biggest economy in the region which also went through a recession in 2012, when it shrank by 1.7%. Unemployment in Serbia, too, has reached record heights of 23.9% as here, too, the youth and long-term unemployment are huge across the country. One of the main reasons the Commission revealed is the clumsy labour legislation. The fiscal discipline is also quite unstable. In the election year (2012), the government spending skyrocketed and entirely deleted the not very bold previous efforts for fiscal consolidation. The deficit instead of the expected 4.25% reached 6.4% of GDP, but without taking into account the money for bank recapitalisations and called guarantees. In 2013, the expectations, again, were far from reality. According to the Commission, the main problem is not only bad budgetary planning, but also the inefficiency of spending and the high spending on wages and pensions.

Another factor for the growing of spending and debt is that the state holds majority stakes in many sectors like energy, transport and telecommunications. Serbia has a debt ceiling of 45% of GDP, but it violated it when in 2012 the debt reached 60 per cent. As in all the other countries in the region, in Serbia too, the banking sector is dominated by foreign banks. Here, too, there is significant growth of non-performing loans - up to 19.9% in June 2013. The economy is dominated by services, although the share of agriculture remains big. EU remains a major trade partner to Serbia in 2012 with 58.1% share of the overall export and 58.2% of the imports.

Albania awaiting the candidate status

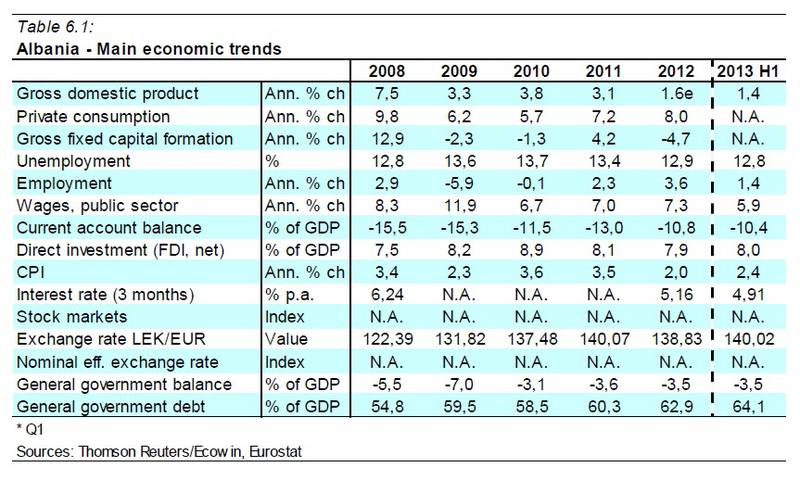

Generally, the Albanian economy was sheltered from the recession, but the dynamics of growth slowed down in 2012 to 1.6% of GDP which is a serious decline compared to 3.1% in 2011. The country, however, has serious imbalances. The current account deficit, although declining, was 10.5% of GDP in 2012. In 2011 it was 13 percent. The unemployment, too, is high, although not as much as in the above mentioned countries - 13%. In the first half of 2013, the number of unemployed slightly declined to 12.8%, but the long-term unemployment covers two thirds of all unemployed which reveals structural  problems. The problem is, though, that statistics is very poor, apart from the very large informal sector which prevents the more precise number of jobless people.

problems. The problem is, though, that statistics is very poor, apart from the very large informal sector which prevents the more precise number of jobless people.

The fiscal discipline is relatively strict in Albania where the budget deficit increased from 3% the previous year to 3.4 per cent in 2012. The debt, however, is quite high and in 2012 reached 62.9% of GDP, exceeding the 60% threshold, abolished in December 2012. In the banking sector the situation is also worrying and quite telling for this is the level of non-performing loans - 24.4% in the second quarter of 2013. In general, Albania's economy is services-oriented. The second important sector is agriculture. The production base is not diversified, the problems with electricity supply and the size of the informal economy remain the main challenges for the Albanian economic development. The GDP per capita remained at 30% below the EU average in 2012.

Bosnia and Herzegovina - the biggest challenge before the enlargement policy

The Dayton invention is the only exception in terms of national consensus for economic development. "[...] despite some slight improvement, the consensus on economic and fiscal policy essentials remains weak", is said in the Commission's report. In 2012, the Bosnian economy shrank by 1.1%, but in 2013 an improvement started. Bosnia, however, is among the countries that have serious imbalances. The current account deficit in 2012 reached 9.5% of GDP and is funded mainly by foreign borrowing, as the World Bank is the biggest creditor.

In terms of unemployment, Bosnia is not an exception from the general picture in the Western Balkans with levels of 28.6% in 2012. Instead, the number of employed in the public sector is growing. The management of the public finances in general is bad. The public debt is growing and in the end of 2012 it was 44% of GDP. The business is having hard times to survive in the difficult political environment and still needs registration in the two state entities - Republika Srpska and the Bosnia and Herzegovina Federation. In the former, the registration of firms was significantly reduced from 23 to 3 days and the price also dropped to 200 euros. But in the Federation, the establishment of a company is much more complicated and expensive. The share of non-performing loans is also high and growing. In the second quarter of 2013 they reached 14.3%. Bosnia and Herzegovina's public sector is huge and inefficient, as many of the competences overlap or are duplicated.

In terms of unemployment, Bosnia is not an exception from the general picture in the Western Balkans with levels of 28.6% in 2012. Instead, the number of employed in the public sector is growing. The management of the public finances in general is bad. The public debt is growing and in the end of 2012 it was 44% of GDP. The business is having hard times to survive in the difficult political environment and still needs registration in the two state entities - Republika Srpska and the Bosnia and Herzegovina Federation. In the former, the registration of firms was significantly reduced from 23 to 3 days and the price also dropped to 200 euros. But in the Federation, the establishment of a company is much more complicated and expensive. The share of non-performing loans is also high and growing. In the second quarter of 2013 they reached 14.3%. Bosnia and Herzegovina's public sector is huge and inefficient, as many of the competences overlap or are duplicated.

Kosovo - a young, dynamic and full of unemployment country

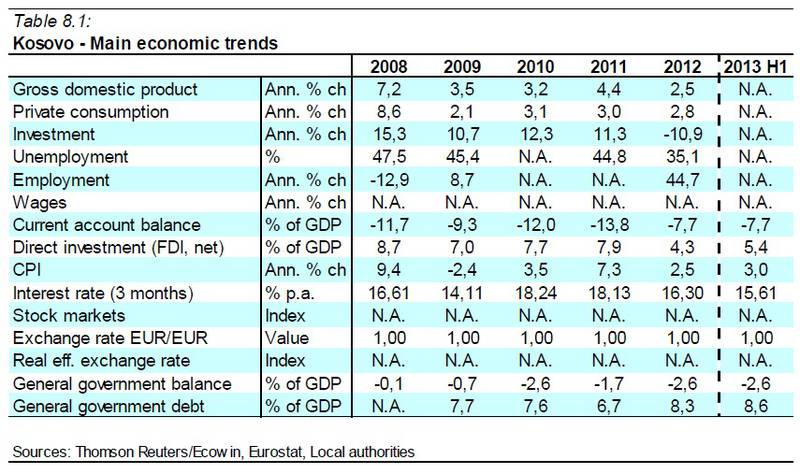

Kosovo has the most dynamic economic growth than all the others in the region, but it felt the cold from Europe's economic troubles, not very strongly though. From 4.4% the economic growth declined to 2.5% in 2012. The country has gross domestic product per capita of 11% of the EU27 average. Unemployment is 35.1%, but comparisons with previous periods cannot be made due to recently introduced changes in the methodology and the high level of informal economy. Kosovo and Bosnia and  Herzegovina - the two most difficult solutions from the war in former Yugoslavia - have the biggest problems with statistical data and generally the analysing of the main macro economic indicators.

Herzegovina - the two most difficult solutions from the war in former Yugoslavia - have the biggest problems with statistical data and generally the analysing of the main macro economic indicators.

In order to avoid nationalistic hysteria like the UK's

The deepening of the analysis of the economies in the enlargement countries in the Western Balkans will probably support the European Commission's and EU's efforts to prepare them and themselves for the next enlargement wave. When will it be is too early to forecast, but it is certain that it will depend mainly on the efforts of the candidate countries to fulfil the growingly more precise criteria and the assimilation of the lessons from previous enlargements. Youth unemployment should be among the biggest concerns for the EU in the context of the visa-free regime and also against the backdrop of the hysteria with the abolishment of labour restrictions for Bulgarians and Romanians from January 1st. The conclusions in the same vein of the December EU summit welcome the Commission's efforts to increase the dialogue on the economic governance with these countries.

In this regard, the Council will be discussing how exactly to improve the bilateral and multilateral dialogue with them, including through cooperation with the major international financial institutions. The key, however, should be money for reforms. Otherwise, it could hardly be expected the Union to open its doors again in the coming decades, especially bearing in mind that the Union already has quite enough problems of its own that stemmed from previous enlargements.

Bakir Izetbegovic, Andrej Plenkovic | © Council of the EU

Bakir Izetbegovic, Andrej Plenkovic | © Council of the EU Aleksandar Vucic, Recep Tayyip Erdogan | © Serbian Presidency

Aleksandar Vucic, Recep Tayyip Erdogan | © Serbian Presidency Jean-Claude Juncker, Zoran Zaev | © European Commission

Jean-Claude Juncker, Zoran Zaev | © European Commission