The Services Directive – in the Reality and in the "What If" Domain

Adelina Marini, Zhaneta Kuyumdzhieva - trainee, June 29, 2012

Do you remember The Polish Plumber? Or, rather, do you remember the panic caused by the expected invasion and conquering of Europe by Polish plumbers? The character emerged in 2006 as a symbol for the effects of the enlargement of the internal European market in the services sector, proposed with the Services directive by the then Internal Market Commissioner Charlie McCreevy. The panic was due to the fact that the directive was proposed only 2 years after the EU enlargement to the east reinforcing the concerns of many of the old member states that – against the background of globalisation – the opening of the internal market to cheaper services offered in the poorer member states will diminish the number of jobs and will disturb the welfare stability in old Europe. Up until today, this is the reason why – following a lot of agitation, arguments, billboards and other negative advertising – the directive is still not implemented in full, despite it entering into force in the end of 2009.

Do you remember The Polish Plumber? Or, rather, do you remember the panic caused by the expected invasion and conquering of Europe by Polish plumbers? The character emerged in 2006 as a symbol for the effects of the enlargement of the internal European market in the services sector, proposed with the Services directive by the then Internal Market Commissioner Charlie McCreevy. The panic was due to the fact that the directive was proposed only 2 years after the EU enlargement to the east reinforcing the concerns of many of the old member states that – against the background of globalisation – the opening of the internal market to cheaper services offered in the poorer member states will diminish the number of jobs and will disturb the welfare stability in old Europe. Up until today, this is the reason why – following a lot of agitation, arguments, billboards and other negative advertising – the directive is still not implemented in full, despite it entering into force in the end of 2009.

The deepening of the euro area crisis and the increase of the social imbalances and discontent across EU, however, brought the directive back to light as part of EU’s attempts to find the most feasible solution to its current problems. The European market of services was mentioned for the first time in a long time by 12 member states led by UK and Italy, who sent a letter to their colleagues in the European Council and to the EU leaders Jose Manuel Barroso and Herman Van Rompuy and demanded the EU Spring summit to consider 8 essential points to the development of the internal market. The letter pointed out that the services sector  held four fifths of the EU economy but the EU market was suffocating as it was not open enough in this particular sector. The Commission responded by asking “why aren't you implementing?” and pledged to prepare a study for the summer European Council on the implementation of the services directive until now.

held four fifths of the EU economy but the EU market was suffocating as it was not open enough in this particular sector. The Commission responded by asking “why aren't you implementing?” and pledged to prepare a study for the summer European Council on the implementation of the services directive until now.

The study was issued exactly on time for the EU summit on 28 – 29 June and was presented for the first time to the General Affairs Council on 22 June in Luxembourg. In the Council conclusions then it was reminded that “A well-functioning and truly integrated Single Market for services is a key tool for enhancing productivity and competitiveness and, more generally, increasing potential growth and employment in the EU”. The Council underlines that the short- to medium-term growth benefits should be consistent with ongoing fiscal consolidation efforts in the EU. And moreover, reforms such as regulatory improvements in services sectors should be pursued with priority.

The implementation of the reform – real and expected impact

This is the first attempt to assess the economic impact of the Services Directive based on a complex analytical approach, and using extrapolation because of the limited data and varying implementation of the reform across the member states. The major conclusion is that non-implementation leads to artificial fragmentation of the market, limited competition and suboptimal benefits from the opportunities offered by the internal market of services. The Commission report presents data about the reforms progress under the Services Directive and about the achievements in the introduction of a system of “one stop shops” for services. In addition to the current results the analysis makes a projection about the additional mid-term benefits that will follow the full implementation of the directive.

Although the analysis does not cover all sectors in the scope of the directive, the economic benefits from its implementation are significant. The conservative estimated EU-level impact on GDP is 0.8%, with impact varying considerably across Member States (ranging from below 0.3% to more than 1.5%) and mainly determined by combination of the undertaken barrier reduction and the share of the covered sectors in their economies. The Commission study supposes that close to 80% of the gains should be reaped within the first 5 years following the policy shock (barrier reduction from implementation).

Although the analysis does not cover all sectors in the scope of the directive, the economic benefits from its implementation are significant. The conservative estimated EU-level impact on GDP is 0.8%, with impact varying considerably across Member States (ranging from below 0.3% to more than 1.5%) and mainly determined by combination of the undertaken barrier reduction and the share of the covered sectors in their economies. The Commission study supposes that close to 80% of the gains should be reaped within the first 5 years following the policy shock (barrier reduction from implementation).

Given the observed heterogeneity in barriers reduction across sectors and Member States, the Commission study contains "what-if" hypothetical scenarios on the GDP growth impact resulting from the implementation of the directive:

The first scenario is based on the conviction that the member states will continue their reform efforts, further reducing those numerous restrictions which have been only partially reduced and a non-negligible number of those which have been kept unchanged. In this case, the impact is estimated to reach growth of 0.4% of GDP on top of the current 0.8%.

The second and more ambitious scenario provides for the member states to move to the level of restrictions of the five best countries in the EU per sector, which is de facto close to a full elimination of barriers, which will bring additional gains amounting to 1.6% of GDP, on top of the 0.8% under the current level of implementation.

The estimated “central scenario” impact of barrier reductions from  the implementation of the Services Directive – i.e. the effect of actually observed barrier reduction – for the whole EU reaches 3.8% of additional foreign direct investment, 7.2% more trade, and productivity growth by 4.7% for those sectors covered by the analysis. The EU-level impact on GDP reaches about 0.8%.

the implementation of the Services Directive – i.e. the effect of actually observed barrier reduction – for the whole EU reaches 3.8% of additional foreign direct investment, 7.2% more trade, and productivity growth by 4.7% for those sectors covered by the analysis. The EU-level impact on GDP reaches about 0.8%.

Overall, at the EU level, the impacts under the first “what if” scenario for all variables (trade, FDI, and productivity) are about one and a half times than those in the “central scenario” - that is 10.1% for trade, 5.6% for FDI, 7% for productivity, and the GDP would grow with 1.2%

The fulfilment of the ambitious “what if” scenario (“what if – 5 best”) would result in 14.7% trade growth, 12.6% of foreign direct investments, 13.6% in productivity and 2.6% GDP growth.

The above projections on the impact of the barrier reduction in the EU services sector confirm the potential of the directive to create a true internal market of services. Moreover, the analysis does not cover all sectors in the scope of the directive and is based on the assumption of no-barrier change in the services sectors. A back-of-the-envelope calculation suggests that the GDP effect could double to a 1.6% increase at EU level if all sectors, directly affected by the Directive, are included and if the barrier reduction was equally high there as in the covered sectors.

The “one-stop shop” for services – a story in development

Besides the economic impact of the Services Directive implementation, the Commission estimates in its analysis progress in creation and implementation of its administrative instrument too, as a tool to help the business really benefit from the barrier reduction. The Point of Single Contact (PSC) for the service providers is a portal that gives entrepreneurs access to clear, up to date information of the requirements and administrative procedures, including formalities, needed to access and exercise service activities. It is a bold project with a view that a number of procedures across the EU still need to be transferred from paper to electronic form. The application of this tool is subject of the second part of the Commission analysis.

Besides the economic impact of the Services Directive implementation, the Commission estimates in its analysis progress in creation and implementation of its administrative instrument too, as a tool to help the business really benefit from the barrier reduction. The Point of Single Contact (PSC) for the service providers is a portal that gives entrepreneurs access to clear, up to date information of the requirements and administrative procedures, including formalities, needed to access and exercise service activities. It is a bold project with a view that a number of procedures across the EU still need to be transferred from paper to electronic form. The application of this tool is subject of the second part of the Commission analysis.

It is hardly surprising that the progress under this indicator, too, is heterogeneous. That is why the Commission turns again to the “what if” approach. To overcome the lack of comparable quantitative information on the PSC implementation across the EU27, the analysis is based on the World Bank's Doing Business 2012 Database (DB) which is a source of information about the procedural burdensomeness of starting up a service provider. At the EU level, the achieved economy-wide impact of the PSE so far is estimated to amount to 0.133% of GDP, while the additional gain to be reaped from further developments could reach 0.06%-0.15% in the medium run and 0.09%-0.21% in the long run in an ideal scenario.

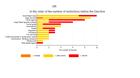

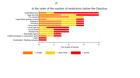

In Bulgaria, the efforts invested so far in the PSC system have achieved  a gain of 0.1163% of GDP. The country specific data sheets point something the Commission has been repeating for long: the barriers that foreign service providers face are many. The legal services are on the top of the chart in terms of number of barriers. They are followed by construction, engineering services, architectural services and the travel agencies. Most easily can operate tax advisers, restaurants, hotels, accountants and real estate brokers. The situation is similar in Estonia – the legal services there face the most barriers.

a gain of 0.1163% of GDP. The country specific data sheets point something the Commission has been repeating for long: the barriers that foreign service providers face are many. The legal services are on the top of the chart in terms of number of barriers. They are followed by construction, engineering services, architectural services and the travel agencies. Most easily can operate tax advisers, restaurants, hotels, accountants and real estate brokers. The situation is similar in Estonia – the legal services there face the most barriers.

It is interesting to mention that the services markets is most closed in countries with the gravest economic problems such as Spain, Greece, Italy, and Portugal. The countries with the most liberalised services markets are Ireland and Finland, as suggested by the graphs in Annex III of the Commission analysis.

It is interesting to mention that the services markets is most closed in countries with the gravest economic problems such as Spain, Greece, Italy, and Portugal. The countries with the most liberalised services markets are Ireland and Finland, as suggested by the graphs in Annex III of the Commission analysis.

The Council of Ministers noted that further liberalisation efforts through strengthened domestic demand would help correct the macroeconomic imbalances within the EU. The Council conclusions from 22 June 2012 stress that the additional adjustment and growth in the services sectors, coming from elimination of non-justified entry barriers and regulation hampering competition and improvements in the business environment, would help accompany the ongoing structural adjustment in several Member States and compensate for employment losses in other sectors.

| © Governo Italiano

| © Governo Italiano | © EU

| © EU | © EU

| © EU