EP: The Resolution Mechanism Must Be Agreed by the End of the Parliament's Term

Adelina Marini, February 9, 2014

The February plenary session ended with a new clash between the Council and the Europarliament this week because, again, an agreement has not been reached in the trialogue on the second pillar of the banking union - the single resolution mechanism (SRM). The MEPs expected a significant movement on the issue which is why they planned not one, but two debates in only one plenary session on Elisa Ferreira's draft report (S&D, Portugal). During the first debate on February 4th, the Council was represented by Greek Foreign Minister Evangelos Venizelos, former minister of finance, whose country took over the Council's rotating presidency on January 1st. But on the second debate, on Thursday, however, there was no representative of the member states, which enraged the MEPs because it prevented them from voting on a new mandate for negotiations.

The February plenary session ended with a new clash between the Council and the Europarliament this week because, again, an agreement has not been reached in the trialogue on the second pillar of the banking union - the single resolution mechanism (SRM). The MEPs expected a significant movement on the issue which is why they planned not one, but two debates in only one plenary session on Elisa Ferreira's draft report (S&D, Portugal). During the first debate on February 4th, the Council was represented by Greek Foreign Minister Evangelos Venizelos, former minister of finance, whose country took over the Council's rotating presidency on January 1st. But on the second debate, on Thursday, however, there was no representative of the member states, which enraged the MEPs because it prevented them from voting on a new mandate for negotiations.

In this way, by voting on a resolution, they practically reconfirmed their old mandate with which the Parliament actually remains at its previous position and that is that the SRM must be able to make quick and independent decisions, while the future single resolution fund (SRF) must begin operations as quickly as possible without waiting for it to be tapped with bank levies in the course of ten years. The problems that need to be solved in the framework of the trialogue, however, are many and are quite complex and in the same time the European Parliament is in a hurry to mark this significant achievement for the solution of the crisis as a major score before the European elections in May. The institution's chief, who is also one of the strongest candidates for European Commission president, Martin Schulz, even described the SRM as the most fundamental project of the current parliamentary term. He was asked by MEPs to write a letter to the Council demanding them to speed up their work on the issue, including by holding an extraordinary Ecofin meeting.

Catch ... 114

One of the problems in the trialogue between the Council, Commission and European Parliament is the legal basis for the establishment of SRM and especially the SRF. Germany believes that Article 114 of the Lisbon Treaty does not provide sufficient legal justification and that is why the EU finance ministers reached an agreement before Christmas on a hybrid community-based and an intergovernmental agreement. But the MEPs are unanimous that Article 114 is sufficiently clear. The leader of the liberal group in the European Parliament and the second confirmed candidate for the European Commission president's position, Guy Verhofstadt, recalled during the second debate on February 6th that all legal services of the EU had confirmed that Article 114 did give sufficient legal basis for the establishment of the new mechanism and the fund. The text of this article can be found here.

Dimitar Stoyanov, a non-attached member from Bulgaria, warned that since the biggest member state raises the issue of legality of the mechanism, then it is only right to think about it and admit that there is a problem with the legal basis. Treaty changes are necessary, but they have to be ratified by referenda in all member states to allow the EU to move on to the next level, the Bulgarian MEP was convinced. He is a former member of the Bulgarian xenophobic party Ataka.

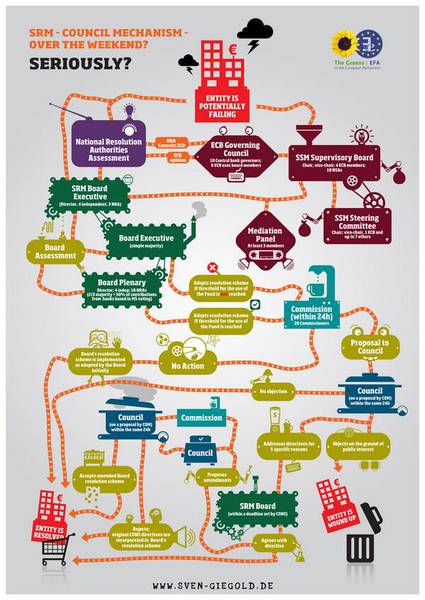

A majority of MEPs were determined not to step back from their demand the mechanism not to be based on an intergovernmental agreement. On behalf of the rapporteur on this dossier, Elisa Ferreira, Antolín SÁNCHEZ PRESEDO (S&D, Spain) warned that the slower the mechanism the more expensive it will be. Sylvie Goulard (ALDE, France) said she was not convinced by the argument for an intergovernmental agreement. It limits its powers too much. "Why do we need an intergovernmental agreement? I don't see a single convincing reason", added Sven Giegold (Germany), a spokesperson of the Greens on economic and financial issues. He recalled that in the agreement, it is envisaged the Council to take the decision to shut a failing bank down. "Do you really believe the Council will ever take  a decision to close a bank?", Sven Giegold asked. On the eve of the February plenary, the Greens' group shared a caricature of the SRM showing how complex it is.

a decision to close a bank?", Sven Giegold asked. On the eve of the February plenary, the Greens' group shared a caricature of the SRM showing how complex it is.

Michel Barnier, the EU internal market commissioner called for realism and said that it would be a real achievement if even an intergovernmental agreement were achieved. Nonetheless, he underlined the European Commission's position was much closer to that of the European Parliament, moreover because the Commission's legal service had established that Article 114 provided legal foundation. He added, though, that there were many ideas that could be put on the table if both sides (the Council and the Parliament) were ready to discuss them. One is the fund to start operations earlier, for example in 7-years time, not in ten. Another idea could be to increase the member states' contributions to 40% in the first year, 30% in the second, 20% in the third and 5% for the fourth and fifth. In the text the MEPs voted on February 6th, they insist the fund to be able to go to the capital markets for funding.

Fast or good?

During the two debates in Strasbourg, however, the details were not at the epicentre of the discussions as was the insistence an agreement to be reached quickly. The shadow rapporteur of the EPP, Corien Wortmann-Kool (The Netherlands), said the negotiations were very slow. She called on the European Parliament and its president in particular to exert pressure on the Council for faster solution of the problem. Vicky Ford (ECR, UK) pointed out that this was a serious and even radical change. That is why the negotiations are so difficult. They affect huge money and the issue should be approached carefully, given that there are nine countries which are not members of the euro area. She described the situation with the mechanism as too many cooks spoil the broth.

Sharon Bowles (ALDE, UK), who chairs the economic committee of the European Parliament, appealed against haste because the Council, indeed, hampered the establishment of the banking union, but haste is an even greater enemy. Bowles said it was not fatal if work were to be left for the  next Parliament. The former EU commissioner from Poland, Danuta Hübner (EPP), also said it was better the SRM to be established well rather than fast.

next Parliament. The former EU commissioner from Poland, Danuta Hübner (EPP), also said it was better the SRM to be established well rather than fast.

During the second debate before voting, the MEPs were very unhappy with the Council's absence and the lack of agreement. Corien Wortmann-Kool again pushed and said that the banking union had to be completed before the European elections. Hannes Swoboda (Austria), the leader of the Socialist&Democrats' group, was peremptory saying that the Council's behaviour was completely unacceptable. If the Council took its work seriously, it should act fast and amend its text so that the negotiations can continue. The Council is dragging its feet. It's not the European Parliament's fault, he added, because either the Council does not want a solution or they are lazy. Obviously, the member states want to protect their national interests and that is why they insist on an intergovernmental agreement. However, the banking system is not national, it is European, he added.

Guy Verhofstadt agreed that the Council's behaviour was unacceptable. Currently we have a Trabant, he said, which means a long and sluggish procedure to resolve failing banks. However, we need a Ferrari if we wanted the mechanism to work, he added. Daniel Cohn-Bendit's explanation about the Council's dragging their feet, was the upcoming European elections.

Martin Callanan (ECR, UK) was a pessimist that the Council could reach a compromise. He repeated what Vicky Ford said during the first debate which is that this issue concerned a serious transfer of sovereignty in the euro area. This is in the interest of the UK and that is why his group was to support the text, although it had some concerns. They are related mainly with the non-euro countries. Those that host a lot of branches of eurozone banks should participate in full power in the decision-making process when resolution is concerned, the British MEP said. He called for more clarity who will make the decisions when a big bank in the eurozone fails. "It cannot be allowed a big country to define everything", he said, obviously bearing in mind Germany.

Sampo Terho, a Finnish MEP from another eurosceptic group - Europe of Freedom and Democracy - warned that whatever the mechanism, it should not be promoted as salvation against future crises because banks will always take their own share and the taxpayers will pay one way or another. In the end of the debates, Commissioner Barnier again called for realism and recalled that the trialogue on Wednesday evening passed in a constructive spirit, the Council left the door open. Most  problems ate purely technical, he said and reminded that solution is important because it affects a sector that funds 75% of the European economy.

problems ate purely technical, he said and reminded that solution is important because it affects a sector that funds 75% of the European economy.

Michel Barnier again agreed with the MEPs that a lot of time was wasted, recalling that the Commission's proposal on the second pillar is already six months old and the European Parliament has been calling for a solution for much longer. After the end of the vote the Greek president issued a statement in which it points out that the Council is ready for compromises.

Elke Koenig | © European Commission

Elke Koenig | © European Commission | © European Commission

| © European Commission | © European Parliament

| © European Parliament