An Unashamed Support For Businesses in the New British Budget

Ralitsa Kovacheva, March 27, 2012

The first comments by politicians and media on UK 2012 budget were that it was a budget for millionaires and penalised pensioners and families with children. But as Chancellor of the Exchequer George Osborne said in his speech to Parliament, the budget "unashamedly backs business. And it is on the side of aspiration: those who want to do better for themselves and for their families." The budget is keeping for the next five years too the course declared by David Cameron's government when it came to power - less state benefits, more incentives and opportunities for working people and business. Naturally, the most discussed part of the budget is

The first comments by politicians and media on UK 2012 budget were that it was a budget for millionaires and penalised pensioners and families with children. But as Chancellor of the Exchequer George Osborne said in his speech to Parliament, the budget "unashamedly backs business. And it is on the side of aspiration: those who want to do better for themselves and for their families." The budget is keeping for the next five years too the course declared by David Cameron's government when it came to power - less state benefits, more incentives and opportunities for working people and business. Naturally, the most discussed part of the budget is

tax reform.

There is something both for the poorest and the richest. From next April the personal allowance will be increased to 9,205 pounds (per year). However, the top rate of income tax (for income over 150,000 pounds) will be reduced from 50% to 45%. The finance minister explained that the reduction would cost the budget only 100 million pounds a year and five times more money would be collected from the richest, thanks to the new measures against tax avoidance and other taxes. For example, the introduction of a new 7% rate of the Stamp Duty Land Tax for residential properties over 2 million pounds and 15% rate when these are purchased by companies.

Pensioners will no longer enjoy age-related tax allowances. The measure will save the budget 1 billion pounds per year by 2015. The government aims for a single personal allowance of 10,000 pounds for workers and pensioners by 2015. To the criticism that this would reduce the income of pensioners George Osborne replied that no one would lose money because pensioners will receive "the largest ever cash increase in the Basic State Pension of 5.30 pounds a week." However, HM Revenue and Customs estimates that future pensioners will be worse off in real terms, thanks to inflation. Retirement, however, starts receding further and further in time for the British, since the government announced that the retirement age will be increased automatically in conformity to the increased longevity.

One of the most criticised measures is the reduction of child benefits for people earning more than 50,000 pounds per year and their removal from those earning more than 60,000 pounds. "I simply could not justify asking those earning £15,000 or £30,000 to go on paying Child Benefit to those earning £80,000 or £100,000," the chancellor said.

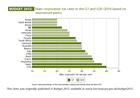

However, since the changes in personal taxation provoked strong disputes,  government`s policy in terms of business is quite unambiguous and undoubted. Under the slogan "to create the most competitive tax system in the G20," the government reduces the corporate tax rate to 24% from April 2012 and to 22% in 2014. As emphasised by George Osborne, that rate is "dramatically lower" than the main British competitors - 18% lower than the US, 16% lower than Japan, 12% below France and 8% below Germany.

government`s policy in terms of business is quite unambiguous and undoubted. Under the slogan "to create the most competitive tax system in the G20," the government reduces the corporate tax rate to 24% from April 2012 and to 22% in 2014. As emphasised by George Osborne, that rate is "dramatically lower" than the main British competitors - 18% lower than the US, 16% lower than Japan, 12% below France and 8% below Germany.

At the same time, from April 2013 the government will introduce corporation tax reliefs for the video games, animation and high-end television industries, in expression of its ambition to make Britain "Europe’s technology centre." In his speech to Parliament George Osborne said that the tax credit for the film industry “helped generate over 1 billion pounds of film production investment in the UK last year alone”. A possibility is also introduced of obtaining R&D tax credit from April 2013. A package of oil and gas tax measures will be adopted too.

Investments in support of growth

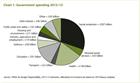

Since until now it was mainly about how the government would collect money in the state budget, let's see what it will spend it on. The largest items in the budget, quite expectedly, are social protection (207 billion pounds), health care (130 billion pounds), education (91 billion pounds). However, the government keeps reforming these areas to make them more effective, so for less money citizens to receive better public services. The budget for maintaining public order and safety is one third of that for the education - 32 billion pounds (here you can compare with the Bulgarian budget). Defence spending is 39 billion pounds, transport - 22 billion pounds, housing and environment - 21 billion pounds. 46 billion pounds are needed to service the debt interest.

Since until now it was mainly about how the government would collect money in the state budget, let's see what it will spend it on. The largest items in the budget, quite expectedly, are social protection (207 billion pounds), health care (130 billion pounds), education (91 billion pounds). However, the government keeps reforming these areas to make them more effective, so for less money citizens to receive better public services. The budget for maintaining public order and safety is one third of that for the education - 32 billion pounds (here you can compare with the Bulgarian budget). Defence spending is 39 billion pounds, transport - 22 billion pounds, housing and environment - 21 billion pounds. 46 billion pounds are needed to service the debt interest.

The government has planned specific investments to stimulate the economy, employment and innovation. It commits to: develop the road and rail network, including through the creation of an investment platform owned and operated by British pension funds to invest in infrastructure projects (with an initial investment of 2 million pounds in 2013); provide ultrafast broadband coverage to make the 10 largest cities “super-connected” (100 million pounds) and additional 50 million pounds to fund a second wave of ten smaller super connected cities; establish a UK centre for aerodynamics (60 million pounds) to support innovation in aerospace technology and spin-off technologies in other sectors; facilitate access to credit and non-bank financing of SMEs; introduce enterprise loans for young people willing to start their own business; provide additional funding of 270 million pounds for the fund, promoting local economic development and employment; provide 150 million pounds to finance major projects in core cities; provide 100 million pounds, alongside the private sector, for investment in major new university research facilities.

The British government aims to double exports to one trillion pounds by 2020, targeting the emerging economies. Because, in the words of George Osborne, "we sold more to Ireland than to Brazil, Russia, India and China – put together." The government will assist exporters from finding funding to securing temporary private sector office spaces overseas.

The economy grows, the deficit decreases

The British government`s efforts to combine fiscal consolidation with promotion of economic growth seems to be delivering. The economic growth is expected to be modest (0.8%) in 2012, but it will reach 2% next year and 3% in 2015. From 8.7% this year the unemployment will fall to 6.3% by the end of the period. It should be noted that this forecast, as well as all others used as a basis for the budged, is not made by the government but by the Office for Budget Responsibility (OBR), which is a completely independent body established in 2010

The use of independent macroeconomic forecasts for preparing member states` budgets has been also encouraged at European level in the last year. Besides providing independent forecasts, the OBR also analyses the government's fiscal and economic policy and evaluates the results. According to its assessment, there is a 60% chance the government to meet its fiscal targets by the end of the period through the proposed policies and measures. The main risk to the British economy is sill stemming from the situation in the eurozone.

According to the OBR, the budget deficit has halved over the past two years, and it is expected to meet the European limit of 3% in 2014-2015 and by the end of the period the budget will approach to balance. Public debt will reach 76.3% of GDP in 2014-2015 and then it will start decreasing. Public spending is expected to fall from almost 48% of GDP in 2009 to 39% of GDP in 2016-2017. Within 5 years, the planned budgetary consolidation amounts to 155 billion pounds a year, mostly through reducing costs (126 billion pounds) and less by tax increases (29 billion pounds).

As a result, the need for government borrowing has decreased from 157 billion  pounds in May 2010 to 126 pounds this year, 98 billion pounds in the next two years and 21 billion pounds in 2016-2017. It is a priority for the government to maintain low interest rates of long-term British government bonds (2.5%), because even an increase by only 1% would cost the budget 21.4 billion pounds by the end of the period.

pounds in May 2010 to 126 pounds this year, 98 billion pounds in the next two years and 21 billion pounds in 2016-2017. It is a priority for the government to maintain low interest rates of long-term British government bonds (2.5%), because even an increase by only 1% would cost the budget 21.4 billion pounds by the end of the period.

Krasimir Valchev | © Council of the EU

Krasimir Valchev | © Council of the EU | © euinside

| © euinside | © EU

| © EU