Is the Bulgarian Position Against the FTT Justified

Evelina Topalova, November 23, 2011

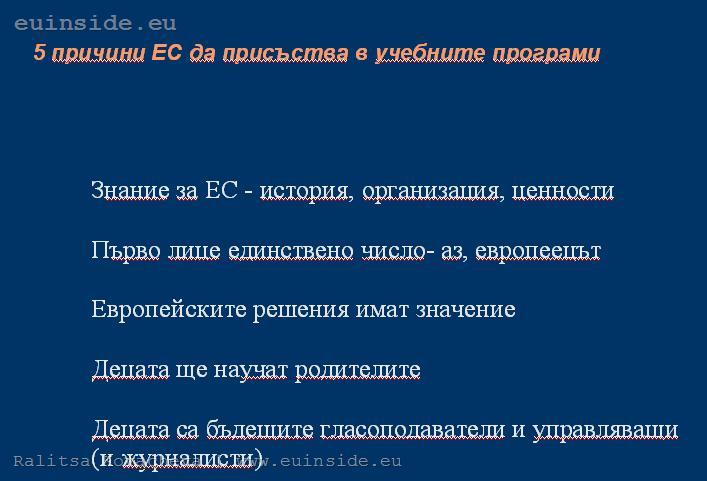

Bulgaria has been an EU member for five years now, but yet there is a feeling that this is a formal membership, which our country does not get maximum benefits from. ‘Brussels’ is still represented by politicians and is perceived by the public as a source of funds on the one hand, and as an excuse for unpopular decisions, on the other. So, euinside decided to spark more active public debates on the strategic Bulgarian goals for development and Bulgaria's commitments as a member of the European Union. Under the project "Horizon 2020: Civil Visions for Reform and Development of Bulgaria in the European Union", funded by the Open Society Institute - Bulgaria, we publish articles on current European issues and the Bulgarian positions on them. Then we seek the reactions of the most active representatives of the civil society, like prominent bloggers.

Bulgaria has been an EU member for five years now, but yet there is a feeling that this is a formal membership, which our country does not get maximum benefits from. ‘Brussels’ is still represented by politicians and is perceived by the public as a source of funds on the one hand, and as an excuse for unpopular decisions, on the other. So, euinside decided to spark more active public debates on the strategic Bulgarian goals for development and Bulgaria's commitments as a member of the European Union. Under the project "Horizon 2020: Civil Visions for Reform and Development of Bulgaria in the European Union", funded by the Open Society Institute - Bulgaria, we publish articles on current European issues and the Bulgarian positions on them. Then we seek the reactions of the most active representatives of the civil society, like prominent bloggers.

So far, two major topics provoked vigorous reactions. One is the Commission's proposal to introduce a Financial Transaction Tax (FTT) and the official Bulgarian position against the proposal. The second topic is, quite rightly, the 2012 budget, which is to be adopted by Parliament. In this summary you will see how the discussion developed on the first topic, and comments on Budget 2012 you can find here.

euinside has presented the entire debate on the FTT in details - the European Commission's proposal, the insistent calls for its introduction by the European Parliament, the heated discussions among finance ministers. At this stage it seems too early for a final decision, given that there are too many unclear practical questions, so many EU countries still do not have a definite position. However, Bulgaria is among the countries that have strongly opposed the idea of FTT, including as a possible source of own resources for the European budget.

Lyubomir Topalov criticised Bulgaria's opposition to the FTT, arguing that "such a tax is not just a good source of revenue for the EU budget. It is an equilibrator and would reduce some of the existing irregularities in the financial markets regulation and hidden revenue, due to the absence of such a tax." In his view concerns that the tax would drive financial institutions out of Europe is "more fiction than reality":"The costs of moving, as well as the costs of doing business with and in the EU, while situated anywhere outside the EU, would be greater than or equal to such a minimum tax. Not to mention the foregone benefits. In short - let's not delude ourselves that the banks would escape from the EU because of such a tax. But the foregone benefits, in terms of budget revenues, would be much more visible in countries like Bulgaria than in countries like Germany, for example."

According to Mr Topalov, a probable cause "Bulgaria to speak in such a definite way about something that is actually harmful to us (for now) is that there is some kind of horse trading with other countries, having a direct interest in this direction."

Jordan Mateev is on the quite opposite position: "The imposition of any tax at EU level would complicate the tax systems and would increase bureaucracy. And the direction of change must be the opposite - simplification of tax systems and reducing bureaucracy." Specifically the FTT is "unfair because it would punish countries with more developed financial systems and would benefit countries with underdeveloped financial systems" and "the tax burden will not be borne by the banks but by the customers, which means by all of us."

According to Jordan Mateev it is high time the leaders to focus on the real problem: "the world's financial system is built in a wrong way and it evidently does not work well, starting from the fact that banks take risks, which are transferred on to the states through deposit guarantees, then go through the mistaken system for credit ratings, and the activities of central banks, and international financial institutions."

| © European Union

| © European Union | © euinside

| © euinside | © EU

| © EU