Who will win in Toronto?

Adelina Marini, June 26, 2010

Economic recovery and a balance of public finances; reform of global financial system; enhancing international financial institutions; building the future through trade liberalisation and investments. These are the priorities of the summit this weekend in Toronto of the 20 most developed economies in the world (Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, South Korea, Russia, Saudi Arabia, South Africa, Turkey, UK, the US and the EU.

Economic recovery and a balance of public finances; reform of global financial system; enhancing international financial institutions; building the future through trade liberalisation and investments. These are the priorities of the summit this weekend in Toronto of the 20 most developed economies in the world (Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, South Korea, Russia, Saudi Arabia, South Africa, Turkey, UK, the US and the EU.

On the first priority the main problem which the 20 must resolve is striking a balance between public finances consolidation and keeping economic growth on track. On this issue most economic experts say that all measures, aimed at reducing public spending will hinder economic growth. Germany is being heavily criticised lately after the country announced an ambitious austerity plan worth almost 80 bn euro, given the fact that its budgetary deficit is not much over the restriction of 3% of GDP in the Stability and Growth Pact of the EU.

But on the other hand, politicians are aware that avoiding great unemployment,  economic crash and deflation through pouring public money in the economy led to the current budgetary crisis in many countries around the world. This is why it would be hard to strike a balance that will allow the otherwise diverse members of the G20 to both get their economies on the path of sustainable growth and in the same time reduce their huge expenditures.

economic crash and deflation through pouring public money in the economy led to the current budgetary crisis in many countries around the world. This is why it would be hard to strike a balance that will allow the otherwise diverse members of the G20 to both get their economies on the path of sustainable growth and in the same time reduce their huge expenditures.

The second problem is financial regulation. And this is a problem because there is no agreement within the Group on how exactly any regulation could be realised on a global level without hindering economic growth and national interests. The European Union has already agreed on a bank levy and transactions fee (an issue also discussed last year at G20 summit in Pittsburgh but with no success). But in order such measures to be effective it is necessary all countries to apply them because globalisation is a reason for many banks to operate trans-borders.

In the meantime, after e 20-hour marathon on Friday a compromise had been reached between the House of Representatives and the Senate of the US Congress on a joint bill for a reform of the US financial system. Achieving an agreement is a great success exactly because it happened on the eve of the G20 summit in Canada. A major pillar of the new regulation is restriction of banks' abilities, whose deposits are federally insured, to trade for their own benefit.

The compromise also stipulates that banks will be required to segregate their deals in the riskiest categories of derivatives, including credit default swaps (CDS), based on mortgage loans. The main goal of the American financial reform is to avoid a repeat of taxpayers saving the entire banking system, part of which is the banking reform, avoiding the so called phenomenon "too big to fail".

As part of the efforts to ensure global economy recovery will be agreeing on measures against protectionism. World economy is so much integrated already and interconnected, driven by trade and investments. However, this has several aspects, one of which will probably be central during the summit in Toronto - the dispute between China and the US on the value of the Chinese national currency - the yuan (renminbi). The countries with liberal economies say that maintaining artificial stability of the national currency distorts economic logic and causes damages to the others.

As part of the efforts to ensure global economy recovery will be agreeing on measures against protectionism. World economy is so much integrated already and interconnected, driven by trade and investments. However, this has several aspects, one of which will probably be central during the summit in Toronto - the dispute between China and the US on the value of the Chinese national currency - the yuan (renminbi). The countries with liberal economies say that maintaining artificial stability of the national currency distorts economic logic and causes damages to the others.

China on its turn still refuses to perceive itself as one of the most developed countries (it prefers developing) and claims that it needs yuan's stability in order to generate growth.

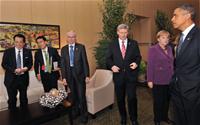

In other words, it looks as if the summit will be interesting. Before the G20 summit there is a meeting of the G8 leaders in another Canadian city - Muskoka.

| © European Union

| © European Union | © European Union

| © European Union | © European Union

| © European Union | © The Kremlin

| © The Kremlin