The second Greek bailout will probably amount to 85 billion euros

Ralitsa Kovacheva, July 10, 2011

By mid-2014 Greek government will need funding worth 172 billion euros, the fourth review of the implementation of Greek economic programme shows, agreed last year with the IMF and the EU. The document, published by the European Commission, includes a detailed review of all measures under the programme, and also the new commitments stated in the Greek mid-term fiscal strategy and the privatisation programme.

By mid-2014 Greek government will need funding worth 172 billion euros, the fourth review of the implementation of Greek economic programme shows, agreed last year with the IMF and the EU. The document, published by the European Commission, includes a detailed review of all measures under the programme, and also the new commitments stated in the Greek mid-term fiscal strategy and the privatisation programme.

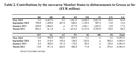

For a year the eurozone countries and the IMF have granted to Greece almost half of the 110 billion euros loan, approved last May - 53 billion euros. (In the table you can see the breakdown of the amount paid by the euro area countries). This means that Greece has yet to receive 57 billion euros from the current loan, including the notorious fifth installment of 12 billion euros, which will be disbursed by 12 July.

the 110 billion euros loan, approved last May - 53 billion euros. (In the table you can see the breakdown of the amount paid by the euro area countries). This means that Greece has yet to receive 57 billion euros from the current loan, including the notorious fifth installment of 12 billion euros, which will be disbursed by 12 July.

The Greek government must also provide privatisation revenues which by mid-2014 are expected to reach about 30 billion euros (according to the plan the total amount by 2015 should be 50 billion euros). This means that the amount needed to complement the total of 172 billion euros is 85 billion euros. This probably will be the value of the second bailout for Greece from the EU and IMF, aimed at helping the country to meet its financial needs by mid-2014. Until then it is expected Greece to be able to raise market funding. “Moreover, private sector involvement, according to which bond holders would voluntarily agree to roll over a share of the bonds that mature in this period, would decrease the need of additional official loans,” the document says.

Meanwhile, negotiations on the issue have stalled after the rating agencies warned that the French plan for a voluntary roll-over of Greek debt by the private sector would trigger a downgrade of Greece's credit rating. The Financial Times reported a reversal of the Dutch position on the issue, as the country considered that there should be a mandatory involvement of private sector, since the agencies would declare a Greek default anyway. The article quoted Dutch finance minister Jan Kees de Jager after a meeting in London with his British colleague George Osborne: “If a mandatory contribution from the banks leads to a short-term and isolated rating event, that is not so bad, because Greece cannot go to the credit markets anyway now or in the near future.”

Although it is unclear how many of EU's financial ministers share their Dutch colleague’s view, the likelihood the EU to demonstrate a clear reluctance to comply with the warnings of rating agencies seems more real. The reduction of Portugal's credit rating by Moody's provoked European Commission President Jose Manuel Barroso to say: “Our institutions know Portugal a little bit better. Our analysis is more refined and complete”. According to Mr Barroso, the agency's decision was “biased” and “speculative”.

“It's also clear that a small group, a small oligopolistic structure, is not what is probably desirable at the level of global finance,” Jean-Claude Trichet, President of the European Central Bank commented. The ECB clearly demonstrated its attitude to the opinion of rating agencies by deciding to suspend a minimum rating requirement for Portuguese bonds, as a result of the downgrade. Thus the ECB gave its support to the country at a time when expectations Lisbon to resort to a second bailout had increased market tensions. Such rumours are spreading also about Ireland, although recently the authorities have denied such a need.

Both countries, however, do not suffer from the image problem of Greece. The evidence of wasteful government policy, which has been published in the course of last year, closed the country's access to markets for a long time. So Greece has to show it can win back the trust of both - its partners in the EU and investors - by starting to implement the remedial measures, this time for real.

As to the measures, I did not counted them, but they seem to be thousands. The review of the implementation of the Greek economic programme provides a truly comprehensive picture of the real situation in Greece and is also a really interesting and instructive paper. It details the measures announced by Greece in terms of fiscal consolidation, structural reforms and promoting economic growth, the degree of implementation, problems the Greek government is facing, and recommendations on how to solve them. This makes the document a useful “manual” for governments facing similar challenges.

As euinside wrote in details about the medium-term fiscal strategy, I will not go into details but will only give you one example of how detailed the review is. While reviewing the measures in the area of healthcare, the experts consider that the use of generic medicines in hospitals of the national health system stands at 12.5%, well below the target of 50 percent. Generic products are cheaper than the original ones and their use can ease public spending on health. A curious detail is that, according to the document, the reason this measure not to be fulfilled yet is resistance among doctors. On this occasion 100 prescription rules will be published, although they won't be binding.

Such interesting details can be read in all problematic areas, especially where there has been no success. Therefore, as noted the report, the outlined measures must be implemented rigorously, fully and timely. This is the biggest challenge now facing the country. Otherwise, the default is a fact, regardless of whether it will be officially announced or named with a more sophisticated expression.

Klaus Regling | © Council of the EU

Klaus Regling | © Council of the EU Mario Centeno | © Council of the EU

Mario Centeno | © Council of the EU Mario Centeno | © Council of the EU

Mario Centeno | © Council of the EU