European Commission Wants, But Member States Don't Allow

Adelina Marini, May 21, 2013

In the middle of the battle between austerians and spenders, which approach is the best to herd economic growth on in the suffering from recession, crises, populist and various social concussions European Union, the leaders of the member states will gather together in the middle of the week to discuss one of the most difficult to achieve ways to boost common prosperity - making energy and taxation policies common. Knowing the member states' positions on the two topics, the upcoming summit on Wednesday, May 22nd, only a month before the traditional, big and drawing the future June European Council, seems a bit unnecessary. Moreover, bearing in mind that not much has changed since Herman Van Rompuy called on February 4th 2011 the first European Council dedicated entirely on energy, but again overshadowed by the eurozone woes.

In the middle of the battle between austerians and spenders, which approach is the best to herd economic growth on in the suffering from recession, crises, populist and various social concussions European Union, the leaders of the member states will gather together in the middle of the week to discuss one of the most difficult to achieve ways to boost common prosperity - making energy and taxation policies common. Knowing the member states' positions on the two topics, the upcoming summit on Wednesday, May 22nd, only a month before the traditional, big and drawing the future June European Council, seems a bit unnecessary. Moreover, bearing in mind that not much has changed since Herman Van Rompuy called on February 4th 2011 the first European Council dedicated entirely on energy, but again overshadowed by the eurozone woes.

There is neither a chance the member states to abandon their national interests, especially their powers to negotiate the most lucrative for them conditions for delivery of energy resources, nor are they inclined to grant the European Commission more powers to interfere in their taxation policies. And with the crisis into its sixth year, the citizens of the member states are ever more rarely finding a meaning in any common actions that could "burden" them additionally for the sake of a long-term or, indeed, quite distant common future.

The impossible common energy policy

Last but not least, it should be noted that the summit on Wednesday will be very brief and is not expected to continue into the night because some leaders already have other meetings scheduled the same day. Many are going to attend the big gathering of Socialists in Leipzig. In an effort to save time, at least this is what European Commission President Jose Manuel Barroso and European Council chief Herman Van Rompuy explained, two documents were sent to the member states outlining the state of play in the area of energy and tax policy and what the Commission has proposed so far, while the member states have not implemented or have not completed. According to the special letter Mr Barroso sent to the member states, the energy mix is quite various throughout the EU, although the challenges are similar. In some countries the prices of basic energy resources are very high, while in others they are not. That is why, the main aim of Mr Barroso and Mr Van Rompuy will be to call on the leaders again to work for the completion of the single energy market.

It is already urgent, Barroso writes, to complete the transposition and implementation of the third energy package, which Russia is trying in every possible way to resist or even sabotage. It is also necessary to undertake urgent measures to facilitate private and public investments, especially at EU-wide level in energy infrastructure. Currently, the common energy mix of the EU is showing strong and growing dependence on import of energy sources and toward certain suppliers. In 2011, the common energy needs of the EU were covered by the following sources: 35% oil, 24% natural gas, 17 per cent fossil fuels, 14% nuclear energy, 10% renewables. The situation, however, differs from country to country which can be seen in the Commission tables.

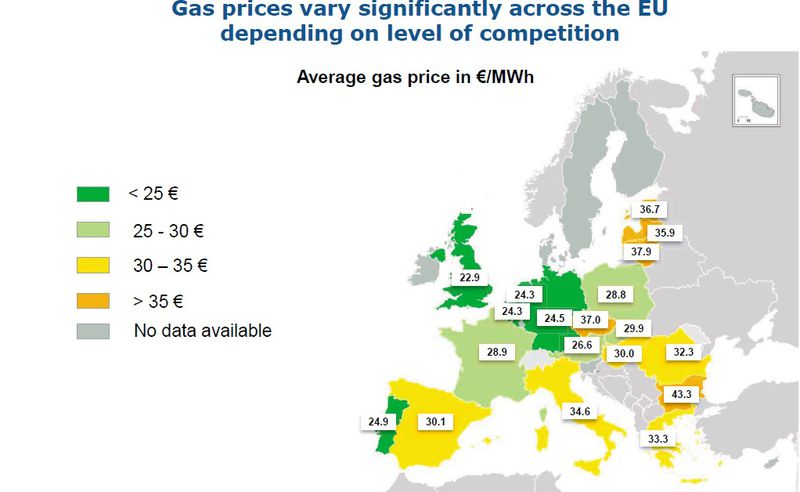

Europe's dependence on imports has increased in the past two decades and is expected to exceed 80% in terms of oil and gas by 2035, while some countries rely on a sole supplier - Russia - for 80 and ever 100 per cent of their natural gas consumption. That, the Commission believes, exposes them at the risk the prices at which they buy energy not to be formed on a market principle, which Bulgaria is well aware of. And again according to Commission estimates, Bulgaria is the only country in the entire EU where the price of natural gas is the highest - 43.3 euros MWh. The lowest is the price Britain pays - 22.9 euros MWh. Even neighbouring Romania pays significantly lower price than Bulgaria - 32.3 euros.  The Baltic states are also in the group of EU countries importing the most expensive natural gas compared to their peers.

The Baltic states are also in the group of EU countries importing the most expensive natural gas compared to their peers.

And although it does not say directly that it supports shale gas, European Commission points out in a document of its that while Europe's dependence on fossil fuels is increasing, the US is on its way to turn from an importer into a net exporter. According to the document, the differences of prices for electricity against which thousands of Bulgarians rebelled last winter, are defined to a large extent by the price of fossil fuels and by the recently rebound production of oil and natural gas in US, especially shale gas, which leads to widening of the gap between energy prices for industry in Europe and US. In 2012, the industrial prices of gas were more than four times lower in the US than in Europe, which is definitely to the detriment of competitiveness of European companies.

The Commission also points out that although it is very unlikely Europe to become self-sufficient in natural gas, the optimistic scenario outlined in a recent study by the Commission shows that it is possible the import dependence to be kept at the level of 60%. Estonia is quoted as an example because it covers 90 per cent of its energy needs from shale oil mining. The Commission refuses to declare whether it supports shale gas extraction in general, but it points out that it does want to ensure safe and secure extraction. The decision for this, however, is with the member states, a spokesman of the Commission said last Friday during a special Twitter chat on the issue. But EU Climate Change Commissioner Connie Hedegaard is firmly against "the US-type shale gas revolution". According to her, the member states should focus more on energy efficiency as a much more effective way to reduce prices in Europe, "rather than the dreams of a US-type shale gas boom".

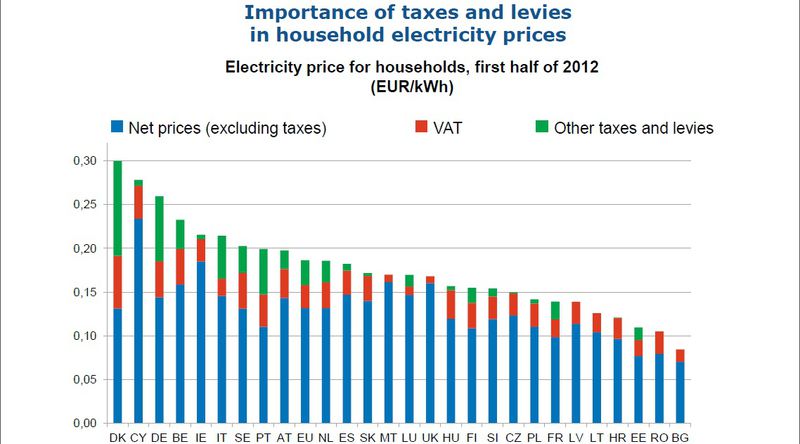

Except import and fragmentation of the energy market, another reason for the high prices of electricity in some member states where the share of bills reaches 22% of all spending, are the state imposed levies, including subsidies. In some countries like Denmark, for instance, the taxes and levies on certain categories of electricity and gas consumers constitute up to 50% of the final energy bill. According to Commission estimates, Bulgaria is not among the countries that suffer from additional taxes. The table shows that the only supplement to the net price of electricity for households is VAT. That fact contradicts with the claims of the potential prime minister of Bulgaria, Plamen Oresharski, who was a minister of finance in Sergey Stanishev's government (2005-2009). In his economic plan, quoted by The Sega daily, it is proposed the transport levy to be abolished, which currently is 17.52 euros MWh for traders. That price includes, however, the "green component" - the subsidies for production of energy from renewables.

Except import and fragmentation of the energy market, another reason for the high prices of electricity in some member states where the share of bills reaches 22% of all spending, are the state imposed levies, including subsidies. In some countries like Denmark, for instance, the taxes and levies on certain categories of electricity and gas consumers constitute up to 50% of the final energy bill. According to Commission estimates, Bulgaria is not among the countries that suffer from additional taxes. The table shows that the only supplement to the net price of electricity for households is VAT. That fact contradicts with the claims of the potential prime minister of Bulgaria, Plamen Oresharski, who was a minister of finance in Sergey Stanishev's government (2005-2009). In his economic plan, quoted by The Sega daily, it is proposed the transport levy to be abolished, which currently is 17.52 euros MWh for traders. That price includes, however, the "green component" - the subsidies for production of energy from renewables.

The European Commission believes that there is much room for improvement that could lead to a decline in the costs for energy for households. One of the most important things is the implementation of the third energy package which has to be concluded by 2015. It could lead to benefits amounting to 8 billion euros per year. It is not unlikely the benefits to rise to 30 billion euros annually if the 27 member states integrate fully their natural gas markets. In terms of electricity, the benefits of integration are estimated to be 35 billion euros annually. So far, the implementation of the third energy package for electricity is not complete in Slovenia, Finland and the United Kingdom. Partial transposition there is in the same countries plus Lithuania. It is important to note, however, that in order for the package to work it requires national certification of independent operators which is not done in Bulgaria, Estonia, Finland, Lithuania, Poland, Portugal, Romania and Slovakia.

Don't touch our taxes!

The second big topic the leaders will discuss on Wednesday is measures against tax havens, tax fraud and tax evasion. According to Commission estimates, the member states manage to collect only half of the VAT revenues while offshore financial centres continue to dominate the trans-border market of deposits. According to calculations by Brussels, the EU member states lose tens of billions of euros to tax havens, while fraud and evasion limit the governments' capabilities to increase their revenues and to implement their economic plans. In other words, in order to stop austerity the governments have to increase their revenues from taxes without this to include raising taxes. What the Commission will strive  for is increasing transparency and enhancing efforts on national, European and global level to fight tax fraud and tax evasion. One of the Commission proposals is broadening the scope of the Savings Directive.

for is increasing transparency and enhancing efforts on national, European and global level to fight tax fraud and tax evasion. One of the Commission proposals is broadening the scope of the Savings Directive.

Besides, the Commission proposes an action plan to strengthen the fight against tax fraud and tax evasion as well as recommendations to fight tax havens and aggressive tax planning. At their last meeting last week, however, the ministers of finance firmly resisted the attempts by the Commission to interfere in their taxation policies. In the Council conclusions, the work of the Commission is kindly welcomed on developing measures to fight tax fraud and tax evasion, but it is underlined that the Commission recommendations are not legally binding. For more certainty is quoted Article 288 from the Treaty on the Functioning of the EU (TFEU), which states that the recommendations do not have binding power. It is also underlined that within the EU the measures to fight tax fraud and tax evasion should be entirely left in the hands of the member states.

Against the backdrop of the presented last week ideas of French President Francois Hollande about the future of the euro area and the EU at large, as well as the forthcoming decisions about the creation of a banking union, it is very likely the main topics on the agenda on Wednesday to be again overshadowed.

David Cameron, Jose Manuel Barroso | © Council of the EU

David Cameron, Jose Manuel Barroso | © Council of the EU Ildikó Gáll-Pelcz | © European Parliament

Ildikó Gáll-Pelcz | © European Parliament