Eurogroup and IMF Have Come Closer to Agreement on Greek Debt

Adelina Marini, April 26, 2016

The end of the dispute between the International Monetary Fund and the EU on the third Greek bailout programme is now near. This became evident during the informal meeting of the Eurogroup in Amsterdam last Friday. A compromise solution was reached then, which allows for the IMF to receive guarantees for the implementation of the Greek bailout. In response, the Fund demonstrated willingness to soften its position on the Greek debt. All that is left is arranging the details, which will finally clear the way for the completion of the first review of the programme’s implementation, and consequently for the disbursement of the agreed tranches. The review was supposed to be finalised all the way back in the previous autumn, but because of the disagreements it is not ready yet. The big argument between the Washington-based financial organisation and Brussels rotated around the sustainability of the Greek debt, as euinside reported. According to the IMF, the Europeans’ assessments in the bailout programme are too optimistic and without a new trimming of the debt the programme is impossible to be implemented. Europeans, however, are of the opinion that their estimates are fully realistic.

The end of the dispute between the International Monetary Fund and the EU on the third Greek bailout programme is now near. This became evident during the informal meeting of the Eurogroup in Amsterdam last Friday. A compromise solution was reached then, which allows for the IMF to receive guarantees for the implementation of the Greek bailout. In response, the Fund demonstrated willingness to soften its position on the Greek debt. All that is left is arranging the details, which will finally clear the way for the completion of the first review of the programme’s implementation, and consequently for the disbursement of the agreed tranches. The review was supposed to be finalised all the way back in the previous autumn, but because of the disagreements it is not ready yet. The big argument between the Washington-based financial organisation and Brussels rotated around the sustainability of the Greek debt, as euinside reported. According to the IMF, the Europeans’ assessments in the bailout programme are too optimistic and without a new trimming of the debt the programme is impossible to be implemented. Europeans, however, are of the opinion that their estimates are fully realistic.

Disagreements between the two sides were endangering the programme, which the Greek government has been working hard on and for the first time was not going to be the prime culprit for its failure. And failure was already seen on the horizon, for several key euro area states, led by Germany, do not want to back another bailout for Greece to the amount of 86 billion euro without the Fund’s participation. Friday, however, marked the beginning of the end of another Greek drama. If all details are sorted out over the next few days, an emergency meeting of the Eurogroup could be held as early as Thursday, announced the group’s President Jeroen Dijsselbloem, finance minister of The Netherlands (Socialists and Democrats).

The Deal

Considering the IMF does not yet trust the European institutions’ calculations, it was agreed on April 22 that there will be a package of contingency measures, which the Greek government must adopt in case the forecasts do not come true. These measures amount to 2 percentage points of the Greek gross domestic product and are added to the preliminary measures required of Athens at the amount of 3% of GDP. This makes a total of 5% of GDP. Why two percentage points? All these measures have a common goal and it is reaching a primary budget surplus of 3.5% of GDP by the year 2018. The IMF, however, has way lower forecasts. Its expectations are that the primary budget surplus in 2018 will not be more than 1.5% with the measures in the programme agreed on in August of last year. This is why, the Eurogroup and Greece in particular agree to adopt a legislative package of contingency measures to the amount of 2 percentage points, which is the difference between 1.5% and 3.5%.

Exactly what the complementary package of “contingency measures” will include is yet unclear. What is clear is the IMF’s conditions – creating a special mechanism, which will be triggered automatically in the event of a need for the contingency measures to be implemented. This mechanism needs to be credible and be legislated upfront, which turns out to be a big problem, according to Greek Finance Minister Euclid Tsakalotos, because Greek legislation, and Mr Tsakalotos quoted the French laws as well, does not allow for a contingency to be written in law, that certain measures will be activated when specific conditions are in place. In all cases, Athens is firmly set on cooperating for the creation of such a mechanism, assured the minister. Parallel to the additional package of measures, discussions will begin on the sustainability of the Greek debt, which is a key condition of the IMF. The emergency mechanism is the key to an agreement between the IMF and the Eurogroup, because, as Mr Dijsselbloem explained, there is no support in the  Eurogroup whatsoever for a nominal trimming of the Greek debt, meaning there is no change since the summer when the third bailout programme was negotiated.

Eurogroup whatsoever for a nominal trimming of the Greek debt, meaning there is no change since the summer when the third bailout programme was negotiated.

Attitudes lean towards a re-profiling of the debt, which means moving payment dates further into the future. Another option is reviewing maturities and grace periods once again. Nothing more. IMF boss Christine Lagarde made it very clear that the Fund agrees to concessions, stating on Friday that the Greek debt does not need a nominal haircut, but just re-profiling. She was impressed by the unity and strong support among the 19 euro area ministers for the contingency measures and the emergency mechanism. The IMF has not radically changed its position that the bailout programme must have “two legs” – the measures and the debt sustainability. Differences remain on the second one for now, although the latest Eurostat data of April 21 is way more optimistic. It shows that in 2015 Greek debt was 176.9% of GDP, which is considerably less than the expectations in the winter economic forecast of the European Commission – 179%. In this sense, it will be interesting to see what expectations will the EC lay down in its spring forecast, which will be published on May 3.

The debt is the Fund’s biggest concern, as Ms Lagarde explained once again. She stated that the latest Eurostat data is way more positive “than what we had thought, what all institutions had thought and even the authorities in Greece had figured, so we welcome those numbers”. She did, however, underline that she continues to doubt those numbers. “And if they are accurate, it will have an impact on all our framework calculations”. And she explained her doubts with the fact that it has happened on more than one occasion for Eurostat to adjust its own data. She gave an example with 2013 when an expectation of 1.5% growth was announced in April, but later those expectations were revised down twice, reaching 0.5%, which has serious implications on the expectations for the programme’s fulfilment. This is why the Fund will carefully study the new data and assess how credible it is, she said. This will, however, not affect the complementary measures, added Jeroen Dijsselbloem, but just the matter of when will they need to be activated.

Christine Lagarde insisted that debt sustainability of Greece is still questionable, but explained that if it comes to a new debt operation at all, it is not a precondition for the participation of the IMF in the bailout programme. When will the operation happen depends on the implementation of the measures and the credibility of forecasts. The Eurogroup boss hurried to stress, though, that if a relief of the Greek debt is reached at all, this could happen after 8 or even 15 years. All will depend on the new analysis of the sustainability of the Greek debt. Only later will any measures for its harnessing be discussed. Lagarde kept insisting that reaching a primary budget surplus in 2018 will be difficult.

Moreover, she pointed out that even if this goal were reached, it is not a panacea. “However, the primary surplus at 3.5% for years and years to come, as is currently planned in the forecasts, strikes us as unsustainable economically. It has been achieved in the past, but that doesn’t strike us as something we can use as a parameter for debt sustainability”, she explained. The Greek finance minister, however, thinks that “the economics of the IMF” is not confirmed by the latest Eurostat data either because they are using lesser income expectations, or their base line is lower.

The Greek programme

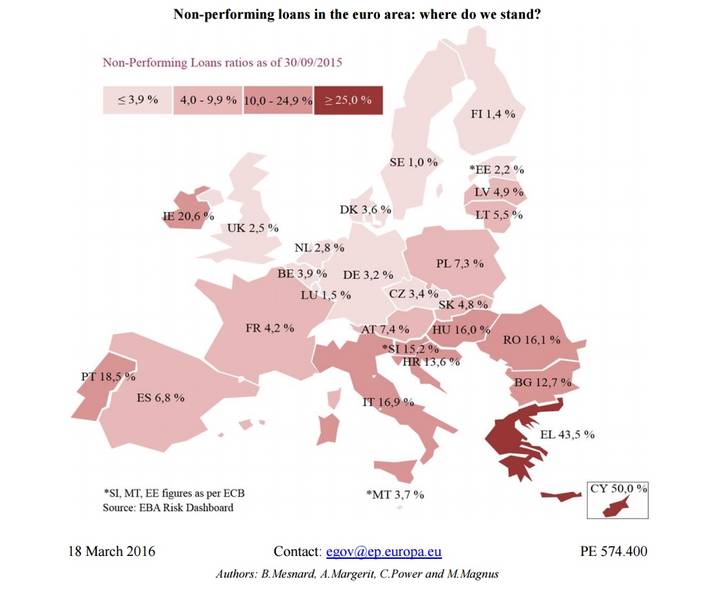

On the other hand, negotiations with Athens have been restarted and European institutions are noting progress. Open issues have become considerably less, including the most difficult ones like the pension and tax reforms, and the creation of a privatisation fund. A very serious problem continues to be the strategy for dealing with nonperforming loans, which, according to data from the European Parliament, are the second highest in the entire EU – 43.5% -- after Cyprus, where this value is 50%. The next country by rank of nonperforming loans in the EU is  Ireland. There, however, the situation is twice better than the Greek one – 20.6%. Sweden has the lowest percentage of nonperforming loans – 1.0%. In Bulgaria this percentage is 12.7, and in Croatia it is 13.6.

Ireland. There, however, the situation is twice better than the Greek one – 20.6%. Sweden has the lowest percentage of nonperforming loans – 1.0%. In Bulgaria this percentage is 12.7, and in Croatia it is 13.6.

According to French member of the Executive Board of the ECB Benoît Cœuré, Greece is making considerable progress in finding a solution to the problem with bad loans, which is of great importance to the central bank. He sees possibilities in the “decisive opening” of the market of loans, which to the ECB is a crucial step to put banks on a stronger footing and to recreate the capacity of banks to lend to the Greek economy. To the EC it is important that whatever is agreed сш will not have a high social price. Economic Commissioner Pierre Moscovici (France, Socialists and Democrats) sees three necessary conditions for the success of the entire programme. Those are continuing with the reforms, negotiating the emergency measures, which will serve as ьх insurance to the IMF and the rest of the creditors and investors, and solving the debt problem.

The latter is very important for the entire euro area, because the European Stability Mechanism (ESM), also known as the euro area’s permanent bailout fund, is currently Greece’s largest creditor. And these are actually the governments of member states. It is exactly due to that that the subject carries such ь high political charge, which, in the current unprecedentedly intense situation all over the EU because of the refugee crisis, the referendum in the UK, and the rise of Eurosceptic forces, could be averted if there is will. This is exactly what everyone has, unlike with any previous Greek drama.

Translated by Stanimir Stoev

Klaus Regling | © Council of the EU

Klaus Regling | © Council of the EU Mario Centeno | © Council of the EU

Mario Centeno | © Council of the EU Mario Centeno | © Council of the EU

Mario Centeno | © Council of the EU