euinside Provoked Heated Debates on the Issue of Tax Harmonisation in the EU

Ralitsa Kovacheva, February 2, 2012

The theme 'For or Against the Introduction of a Common Consolidated Corporate Tax Base (CCCTB) in the EU’ provoked heated debates on this web site, with several prominent economists, analysts and one MEP involved. In the following text I will try to summarise the main points and conclusions which can be drawn at this stage.

The theme 'For or Against the Introduction of a Common Consolidated Corporate Tax Base (CCCTB) in the EU’ provoked heated debates on this web site, with several prominent economists, analysts and one MEP involved. In the following text I will try to summarise the main points and conclusions which can be drawn at this stage.

The economic arguments

Mr Evgenii Kanev, a macro economist and investment consultant, gave several arguments in favour of the introduction of CCCTB:

- If the countries divide the profit in one third turnover/assets/wages, Bulgaria benefits by all export companies because about two thirds of the profit remains in Bulgaria. "Currently the consolidated profit (which is dramatically higher than the profit formed in Bulgaria) is being taxed in the country which owns the business, except taxes paid in Bulgaria."

- If the tax base declines by 22.3% (as stated in the opinion of the Budget Committee in Bulgarian Parliament), this means that the budget revenues decrease by only 1.5%, given that the corporate tax revenues are about 7%. If the rate becomes 15%, in fact revenues will actually increase with all other conditions being equal. "The corporate tax is of a marginal relevance to the budget, then why is this trench warfare because of the tax base? No one has ever raised the issue of the rates!"

- If you save around 100,000 euros paid by an investor to examine Bulgaria's tax regime, maybe Bulgaria will become more interesting for foreign small and medium enterprises (SMEs).

- If Bulgaria loses its tax advantage, moreover only under the hypothesis of harmonisation of the rates too, perhaps the government will be strongly encouraged to improve the business environment.

According to Mr Kanev it is "absurdly to think that low taxes will make Bulgaria a rich country because public infrastructure and services in Bulgaria are appalling, and without them, the economic growth, especially that based on foreign investment, is illusory." He believes that "the secret of the rich societies is also in the public sector with all its services to the private sector, which is never funded with low taxes". However, it does not automatically mean that more money in the public sector will guarantee better services. When an investor comes in Bulgaria and makes a matrix of the investment conditions, the tax rate is his last concern, after taking into account the costs of transport because of poor roads, crime, corrupt state, municipal and customs administration, etc., the economist argued.

Metodi Lazarov also believes that ultimately harmonisation of the tax base will be an incentive to improve the business environment. And Bulgarian companies wishing to expand production and sales in Europe will also benefit from the alleviation for business expected from the introduction of the CCCTB.

Just the opposite view is shared by Georgi Ganev, an economist with the Centre for Liberal Strategies. He gives the example of the high health tax in Bulgaria, which does not stimulate better performance by the health system. According to Mr Ganev, Bulgaria has its grounds to withstand an active position on the issue of tax harmonisation because it is a central issue from the point of view of EU's future development. The pressure to harmonise tax bases is an attempt to continue "the old way of doing things", which is what actually led to "the accumulation of totally unstoppable public debt and deficits" and because of which "in terms of its economic potential and competitiveness, the EU is sinking compared to the world at an increasingly scary speed," the economist argues.

"With only few exceptions, the economies of the old part of the EU are heavily rusted, rotten, unable to adapt, unwilling to recognise the basic economic realities of the modern world." Thus, according to Mr Ganev, "the battle against tax harmonisation is a battle against the continuing bondage of the 'good old way of doing things' that brought us here. [...] It's a battle for the essence and the future of Europe – whether we will change ourselves or not. "

The political arguments

Very interesting comments made Mr Julian Voynov. He is an economist too and as such he delivered comprehensive arguments for the risks to Bulgaria (and not only) arising from the adoption of the CCCTB as it stands, but the more interesting part of his comment is related to the way in which Bulgarian positions are formed. "As I know things from the kitchen, in terms of the preparation of the Bulgarian position, I will only mention that this explicitness of the opinion is defended by 'factors' who believe that Bulgaria should withstand a position at any cost, even if it remains in isolation. A year ago there were statements by Borissov [Bulgarian Prime Minister Boyko Borisov] and Djankov [Deputy PM and Finance Minister Simeon Djankov] in the same vein, although the main instigator remained in the shade." Without claiming that Mr Voynov is necessarily right, the fact is that the formation of the Bulgarian positions on European (and not only) issues in this obscure way leaves plenty of room for such doubts.

As to the question how does Bulgaria defend its position on the European level, Mr Voynov presented two options: "Either we wage war to the death, defending our demands, which will probably put us into a side-track [...] or we try to participate constructively in the debate, suggesting alternatives, so that even we retreat, at least to reduce the potential negative consequences. I am strongly in favour of the second option." What is needed, he believes, as obviously the other participants in this discussion do too, is Bulgaria to make reforms to improve the entire business environment, instead of seeking a PR effect of this "selfless protection of an advantage."

A similar view is shared also by Nadejda Neynsky MEP (EPP, Bulgaria). She said that in terms of globalisation the state "must reshape its philosophy for the implementation of its important public duties." Rather than simply collect and distribute money, the state should focus on creating an environment for economic activity on equal and competing terms, the MEP said. "If a few years ago the consensus was that the state attracts capital with lower taxes, now it should be clear that investor enthusiasm in the current institutional environment has rather drained. And the future of the common market, even if it does not pass through the consolidation of the tax base will face us with the harsh reality of competition under precisely these conditions."

In this sense, the Bulgarian goal should be "not to remain in the periphery of European politics and to withstand constructive solutions together with other small countries with similar structures. But we must also recognise that concessions will be needed to achieve consensus in the European family. It is crucial to agree once and for all which national competences should remain national and regional and which to be centralised in a united Europe. On the other hand, we have to have in mind how relentless global processes are and to improve the conditions of our business environment."

The debate remains open because, on the one hand, the issue itself is very complex, but on the other, it is indicative of the way how Bulgarian positions on European issues are formed. It depends on us, before one or another government decision is taken, as many as possible arguments and positions to be heard. So if you have an opinion on the topic do not hesitate to share it in the comments below the article!

| © European Union

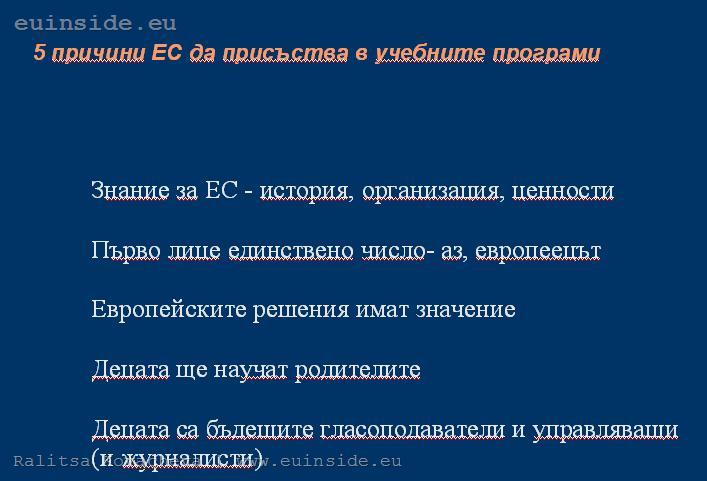

| © European Union | © euinside

| © euinside | © EU

| © EU